Have you ever read the book ‘Think & Grow Rich’? If you’re a regular visitor to Wealthy Gorilla, then you definitely should have read the book...

Want to hear some of Lionel Messi’s success lessons? One of my favorite inspirations is Lionel Messi, the world famous professional football player. Messi is considered...

Want to hear some of Kobe Bryant’s success lessons? Kobe Bryant is a beast; I remember reading a story where he was called up his trainer...

Want to hear some of Bill Gates’ success lessons? Bill Gates is the richest man in the world, after founding Microsoft in 1975. He is now...

Want to hear some of Jay-Z’s success lessons? Unlike many fellow music artists; who will spend all of their money on fancy houses, cars and nights...

For the first fifteen years of my life, I had no problems in my social life. I was never very outgoing, but I always had friends...

We’ve featured a lot of awesomely motivational content on Wealthy Gorilla before, but one thing we’ve never covered before is the best motivational speeches from famous...

When an author writes a book, they’re giving us permission to pass through the gates of their mind, as if to say: “Here yah go, buddy!...

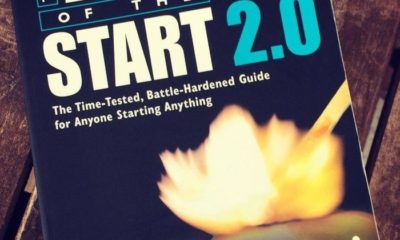

Guy Kawasaki is a best selling author, serial entrepreneur, key employee at Apple and the current Chief Evangelist of Canva. Guy is a huge proponent of...

This article was written to show you some of the best self-improvement techniques that’ll help you change your life. It’s no secret that self-improvement is strongly...

The United States is home to millions of immigrants who travel from all parts of the globe, all for one goal – to have a taste...

In my case, hip hop songs are incredibly motivating for me, they always have been; I created this article exactly three years ago, but I still...

Want to hear some of Gordon Ramsay’s success lessons? Ramsay is known for not taking any sh*t when it comes to his restaurant businesses. If someone’s...

Travelling, one of life’s greatest joys! Travelling is such an incredible experience, and I highly recommend everyone to do it whilst they have the opportunity. For...

There are a ridiculous number of motivational Instagram accounts these days; With it being so easy to get out your phone, and scroll through your feed,...

There are so many factors that can hold you back from achieving success. Things that could make them miss success by just an inch, or even...

First things first…If you think you can just close your eyes, click your heels, and watch the money pour in you’ve got it all wrong. The...

When I first looked on the internet for some examples of stories where famous company startups had almost failed before they succeeded, I couldn’t find much....

It’s been almost a decade since the release of ‘The Pursuit of Happyness‘, and yet it still sticks in my mind as such an iconic inspirational film....

Are you ambitious? Are you a goal getter? Do you have dreams that you are chasing? In an article titled: “Why Do 9 Out Of 10...

There’s a lot of motivational videos on the web; Many of which we’ve featured in previous articles. But how many of them actually target entrepreneurs specifically?...

Now I can’t say that I have the time to sit down and watch many movies at the moment. But, whenever I get a moment free...

I would say that one of coolest things I loved growing up and still to this day is going to the movies. Going to the movies...

Sometimes all it takes is one sentence; It can take one simple sentence to help people change the way they think. A small piece of inspiring...

Do you ever come across a picture that just sums up something perfectly? A picture that puts serious meaning to the “a picture says a thousand...

Everyone needs to do things they hate from time to time. It might be anything from basic chores to a dull part of an otherwise interesting...

Everyone who is striving to reach their goals knows that they need to pump their Grind to maximum level. Whether we want to lose weight, start...

![shutterstock_158121650-[Converted]](https://cdn.wealthygorilla.com/wp-content/uploads/2015/11/shutterstock_158121650-Converted-400x240.png)

![shutterstock_158121650-[Converted]](https://cdn.wealthygorilla.com/wp-content/uploads/2015/11/shutterstock_158121650-Converted-80x80.png)

Life is a race where the finish line is a person’s goals, and in order to win, a person must achieve all of their goals and...

Entrepreneurship is a tough game, and is certainly not meant for those who cannot withstand difficult times. There is more to entrepreneurship and is not just...

As a tween, I loved the Nancy Drew Mystery Series. I wanted to be like Nancy Drew. She had such a good head on her shoulders,...

Some people call it a mantra, others an affirmation, but really…they are slogans; personal slogans. When you think about a company, you think about it’s slogan....

The motivational videos I’ve witnessed being uploaded to YouTube in the past couple of years are phenomenal. The emotions and adrenaline that comes rushing to the...

Want to hear some of Floyd Mayweather’s success lessons? Love or loathe the flamboyant Floyd “Money” Mayweather, there is a lot we can all learn from...

Want to hear some of Gisele Bundchen’s success lessons? Since my early childhood, I’ve been taught how to live right by my mom, dad, sis, two...

Want to hear some of Colonel Sanders’ success lessons? Colonel Sanders was rejected 1009 times before successfully selling his Kentucky Fried Chicken recipe. He had failed...

Want to hear some of Oprah Winfrey’s success lessons? Oprah Winfrey is an incredibly successful talk show host, actress, producer and philanthropist. As she is worth...

It can be scary to go after your big goals; So scary that people have a tendency to pretend that they do not want anything that...

If you’re like me, you probably struggle in staying productive; Sometimes I even have difficulties staying still for a short period of time. In fact, the...

“What’s wrong with being a nice guy?” If this is your reaction, that’s already a sign that you should read this article. After going through Dr....

Want to hear some of Steve Jobs’ success lessons? Steve Jobs was an incredible inspiration in the wonderful world of technology, and without his perseverance and...

Being the best is not an easy task. That’s just the inconvenient truth. Ask Donald Trump, Anthony Joshua, Usain Bolt, Mark Zuckerberg and other successful people...

After becoming the bodybuilding champion of champions, Arnold Schwarzenegger was mocked and told that no one his size, and with such a strong accent, could make...

When we look at the qualities of successful people who have made a name for themselves and have accumulated an abundance of wealth, we should ask...

Are you currently working a fairly standard 9-5 job, but it’s not something you love doing and you want to be able to pursue your dreams,...

Do you often wonder how successful people spend the first hour of their day? It’s a pretty common question to have, considering that success relies a...

Ever feel like you’ve hit a brick wall? You’re not the only one. Almost everybody who’s ever wanted to make something of their life, has hit...

Successful people are role models; However, it hasn’t always been that easy to connect and build a strong relationship with them. Nowadays we have so much...

I don’t know the actual statistics of people that never find their dream job in life, but I can imagine the numbers are pretty high. Do...

You can’t have success without sacrifice; If it was easy enough to become one of the greats without making sacrifices, every tom, dick and harry would...

Do you want to make your first million in your 20’s? With today’s varied and numerous investment avenues and the unlimited knowledge source that is the...

You’ve probably heard it before; put in the hard work and you’ll eventually become successful… They lied to you… It takes a lot more than hard...

Most accomplished individuals and millionaires often find the best way to navigate to success is by questioning the status quo. This isn’t just about asking numerous,...

No matter how ready you are for that job you really want to get, there is one thing that always takes you out of the comfort...

When it comes down to being successful; The majority of people are held back by one simple, yet complicated reason. People are held back from achieving...

Want to hear some of Muhammad Ali’s success lessons? He said; ‘I am the greatest’, and people heard and took him seriously. You bet, had it not...

Once you find your passion, you won’t have to work 100 hours a week to become successful. You will be working as normal but since you...

Want to hear some of Usain Bolt’s success lessons? Usain Bolt does it again; He’s taken another Olympic gold medal away from the 100M Sprint in...

The character of those in leadership roles is important. Most of us recognize this and require it in the leaders that we look to work for....

Jim Rohn is one of the best motivational speakers in the world; If you’re looking for an advancement in your life (be it in your professional...

I am sure the title of this article may have caught your attention and spurned multiple questions in your mind; “What does Dr. Lops mean that...

What is wealth? Many people define wealth within a spectrum of many different values. Wealth can be defined within the context of monetary accumulation, good health...

LeBron James has become an all-star NBA player; There’s no doubt that if you’ve heard of the NBA you’ve heard of LeBron James. He’s been absolutely...

Do you dream of being a boss one day? Whether you are a young professional who has just started early on your career or you are...

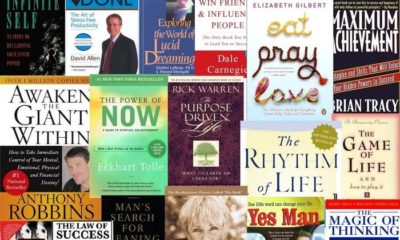

A recent post by Wade Danielson really had me thinking; ‘5 Game Changing Books for Success in Life‘, really had me thinking about the self-help/motivational books...

The phrase “work-life balance” has found its way into countless employee handbooks and recruitment brochures, yet few people ever master the skill of balancing work with...

So you want to help other people? According to a survey by the non-profit group The Conference Board, the majority of Americans are unhappy with their...

The law of attraction is basically stating that “like attracts like”. The idea that by focusing on positive or negative thoughts a person brings positive or...

If you’ve been following Wealthy Gorilla for a while, you’ll know that I love inspirational movies. 9 times out of 10, if I decide to watch...

Have you ever looked at someone and thought, “Wow, he looks like he bleeds money?” If so, this perception you have about the person probably has...

One of the largest sections of any book store (even if e-books on Amazon is your chosen book store) is that on “self-help.” In it, a...

Taking risks; How many of you are young individuals playing it safe and comfortable? Listen up. There are so many reasons why you should take risks...

If you haven’t yet seen the film: The Secret Life of Walter Mitty, I definitely recommend watching it right now. This article will make so much...

A question that a lot of people find themselves asking when they find a dream that they want to work towards, is how can you have...

If you are taking body language for granted, you may be sending the wrong signals and hampering your own progress in life. Some of us live...

The first 20 years of our lives are crazy. We grow from helpless little babies to educated adults with a heavy degree of responsibility. Within these...

Are you the type of person that struggles to grasp the concept of routine? Here’s everything you need to know. In the movie Groundhog Day (if...

In recent years, Life Coaching has become a much more common career for people to go into, with many personal trainers often choosing to go on...

If you don’t already have good role models, are you looking for one? Better yet, do you think your current ‘role model’ isn’t quite what you’re...

2017 is right around the corner people, and it’s the perfect opportunity to sit down and reflect on the past year of your lives. What have...

When you wake up every morning you should have a plan, a blueprint of what you’re about to do for the first hour of your day....

Habits are the key to succeeding in life; Regardless of whether it involves adopting the good ones, or kicking the bad ones. Success will revolve around...

Life is a complicated and tough, yet wonderful thing. We all have our doubts, our fears, our risks, and there are so many decisions we can...

Whenever I was travelling, I would drink a lot of alcohol. Although there were a lot of great nights involved, it wasn’t healthy, and I soon...

I was recently watching a documentary featuring the ‘Subway guy’, where he went to various events across the country as the spokesman for Subway. I forget...

In this article, we’ll look at the effects that TV has on people, and some of the scary facts that you might not be aware of. Most...

We need to start publishing more articles that highlight awesome personal development books on Wealthy Gorilla. They’re so powerful, and provide such a great amount of...

I was browsing through Facebook the other day, and one of my friends had posted a status on these life lessons as described by an 80...

Today’s article is all about caffeine, the thing that we all love and enjoy. We’re going to get into a little bit more detail about caffeine,...

Do you consider yourself a fairly positive person? Let’s find out. This isn’t exactly a post filled with endless positive thoughts. It’s one will help you to...

Many of us suffer with some sort of confidence issue, or fear. Most of the time it won’t just be one issue, but several. You might...

Have you ever just wanted to become a magnet to wealth, prosperity and happiness? So, let me guess – you want to be rich. Nothing wrong...

Do you often feel like you’re incredibly tired after an average day at work? I recently suffered a short period of complete over-exhaustion, for about two...

Distractions are the death of productivity. They surround us and it’s so difficult to escape their grasp. Just one single distraction can stop you from working...

There is nothing that stirs up fear and anxiety-like tight deadlines, nevertheless with the right mindset combined with excellent organization and time management skills, you wield...

Want to learn some simple psychology tricks? These tricks will help you in an incredible number of areas within self-improvement, including communication, first impressions, ability to...

What are thought provoking questions? The meaning of these questions is to get you think deeply about your answers, and the effects they’re having on your...

We love listening to music; Can you imagine NOT having music in your life? It would be like seeing without color. There’s a different style of...

Becoming a professional boxer takes years of dedication and hard work; Boxers are supreme athletes who often dedicate their lives to the sport. Whether you’re competing...

Breakups are seriously tough; In fact, most people struggle to move on quickly. You constantly find yourself missing the other person, wishing you were with them,...

Ever wondered what makes men beta or alpha males? Girls have an incredible ability to read body language and facial features. In most cases they can...