Top Lists

The 10 Best Payment Apps to Use

What are the best payment apps to use right now?

The best payment apps work by allowing you to connect your bank account, debit, or credit card to a digital wallet to send and receive money from family and friends.

Choosing the right payment app can be confusing, with transaction fees, device compatibility, rules for business use, and transaction limitations all varying from one service provider to another.

We’ve run through a selection of the leading payment apps to help you choose the right one for your financial requirements.

The 10 Best Payment Apps

We’ve checked the ease of use, features, and hidden charges for a range of online payment services to bring you this guide to the best payment apps you can download today.

Here’s our list of the 10 best payment apps:

10. Cash App

Best For Transfering Small Sums

Cash App is an easy-to-use digital payment tool for people looking to transfer money in smaller sums for personal use.

The lower limits on the amount of money you can send or receive make Cash App unsuitable for business use, and you won’t be able to use it to pick a bottle of the most expensive wines any time soon.

But if you’re looking for a no-frills app to use for smaller payments online, it’s well worth considering.

Pros

- Linking your bank accounts to Cash App via a debit card is nice and easy

- Cash App offers users access to a digital wallet

- Cryptocurrency traders can use the app to buy and sell Bitcoin

- Cash App will send you a Cash Card on request, which you can use to make digital payments online and in-store, as well as accessing discounts from selected retailers

Cons

- Sending money via credit card comes with a 3% fee

- You can send or receive money up to $1000 during a 30-day period, making it unsuitable for small business owners (limit increases are possible for verified accounts)

- Withdrawals from ATMs are charged a fee

Bottom Line

Developer Square understands the need for a fuss-free payment transfer system, and Cash App allows users to easily connect with their bank account, send money to friends and family, and request money with ease.

While Cash App doesn’t charge fees for most payments and transactions, if you want an instant deposit with instant delivery, this will be subject to a 1.5% fee.

Perhaps the biggest appeal to the Cash App application is the ability to buy and sell Bitcoin via the app, a feature not commonly found on other payment apps.

With that said, it’s worth noting that claims have been made that Cash App is vulnerable to hackers, with some customers reporting resolving issues with the service leading to frustrating customer support.

9. Zelle

Best For Selection of Partnered Banks

Zelle is a US-based payment app best suited for those who want to integrate with their bank or credit unions account to send payments and receive money.

These partnerships make Zelle a good option for simple transactions, so you can pay friends and family and receive payments even when they’re using different banks.

Pros

- Zelle is widely supported by many of the major large banks in America

- Same-day transfers available

- No fees when you send money or when you’re receiving money

Cons

- While Zelle doesn’t charge fees, some banks may do so when you use their service

- International payments are not possible through Zelle

- You can only send money through Zelle from one bank account

Bottom Line

One of the key advantages to Zelle is that it can send money directly from your linked bank account to friends and family, which means there are no fees for the transaction.

This also means you can enjoy instant transfer of your funds, whether you’re using the Zelle app on your mobile device or with Zelle integrated into your personal banking app.

If you’re dining out in one of the world’s most expensive restaurants, you can be confident your payment will clear without any issues.

Zelle is currently partnered with a wide range of banks and credit unions, including Wells Fargo, Chase, Bank of America, Citi, and online banking pioneers Capital One and Ally.

8. Meta Messenger

Best For Facebook Messenger Users

If you’re well inside the Meta ecosystem and are looking for a payment method directly linked to your social media account, Meta Messenger is the perfect way to integrate the two processes with the Facebook Pay system.

Payment through Meta Messenger allows you to send and receive money and make a range of online payments directly from your chat.

Provided you already have a Meta account and are happy to add your debit card information to the account, it’s an easy way to send payments without exiting your social media pages.

Pros

- Existing Meta users can use the messaging app for sending money online

- All payment information is kept private (only the amount sent, your name and profile photo is visible)

Cons

- It can take up to five days to transfer funds

- It can only be used if you have a Meta profile

- Your debit card has to be linked to your Meta account

Bottom Line

Meta Messenger is one of the more limited money apps you can download, primarily for those already signed up to Meta and want to send money to friends and family via their Facebook Pay platform.

While the slow transfer times are off-putting, Meta Messenger does include security features not commonly found on competing payment apps, giving you some peace of mind that your transactions are safe and secure.

If you’re invested in the Meta experience and don’t mind contributing to Mark Zuckerberg’s net worth, this is a simple but effective digital payment service for daily use.

7. Stripe

Best For Small Businesses

Stripe offers users a fully integrated suite of payment products geared towards small businesses and freelance workers, incorporating software and APIs specifically for this purpose.

It’s a resilient payment platform that allows you to receive payments and send money and accepts both credit and debit cards directly to your freelancer account.

You can also use the Stripe payment app to send money internationally, an essential feature in today’s globalized economy.

Pros

- Allows users to generate invoices and regular billing processes

- Transfers customer data across from a different payment system

- Can be used to generate reports summaries

- Supports an extensive selection of currencies and payment methods

Cons

- The first payout through Stripe can take up to 14 days

- Tends to get overshadowed by PayPal

- Open API and tools can be overwhelming for inexperienced users

Bottom Line

With its ability to accept payments from more than 135 currencies and developer tools for creating custom checkout flows, Stripe is a professional payment app ideally suited for freelancers and small business owners.

The service is available at a fixed fee, it’s easy to get started, and it comes with exceptional customer support, which you can access via email, live chat, or over the phone.

While Stripe doesn’t currently accept cryptocurrencies (or the most expensive precious metals) on their platform, this may change, with the company’s co-founder saying it is “not implausible” that the platform would move into digital currency markets in the future.

6. Venmo

Best For Retail Discounts

With its ability to transfer money instantly to either a credit card or debit card, a Venmo account is a popular payment app for peer-to-peer payments.

You can easily send money, make online purchases and receive cash through Venmo, with the option to personalize your communications with emojis and animated stickers.

It’s an intuitive payment app with a clean user interface that allows users to make instant transfers from their mobile devices with just a few taps.

Pros

- A quick and easy app for sending money to friends and family

- Works great on smartphones and tablets

- Includes the option to request money from others

- Compatible with all U.S. bank accounts

Cons

- Charges a fee for instant cash-out transfers to a bank account

- Payment limits of $299.99 each week (can be raised to $2,999,99 per week)

- Lacks Federal Deposit Insurance Corporation (FDIC) insurance

Bottom Line

Venmo is owned by PayPal, so it’s no surprise this is one of the best payment apps on the market.

While it doesn’t offer the kind of extensive tools and support you’d need to run your business, if you’re just sending money to friends and family, it’s a convenient way to send birthday gifts or share a restaurant bill.

Venmo can also be used with participating retailers and companies, including Uber, Foot Locker, and Grubhub, although if you use a credit card to make a payment, Venmo will charge a fee of 3%.

Venmo is compatible with Apple and Android devices and can be quickly installed from the Apple Store or Google Play, but bear in mind this is only designed to work from smartphones.

5. Samsung Pay

Best For Flexible Online Payments

Samsung Pay offers people with Samsung devices the opportunity to sign up to their digital wallet and use it to make payments in virtually any store in the United States.

It’s a great option with no fees attached when using a Samsung Pay account, with the Lite account allowing up to 15 transactions per month of up to $500.

Sign up for the full Samsung Pay account, and the limit per transaction is increased to $3,500 for up to 40 transactions, making this a good option for smaller businesses with lower turnover.

Pros

- Simple to set up

- Accepts credit card payments

- Supported by most major financial institutions

Cons

- Can’t be used for sending money to friends and family

- Only compatible with Samsung smartphones

- Fingerprint scanner can have issues

Bottom Line

While Samsung is perhaps best known for their high-quality electrical equipment, including some of the most expensive TVs you can buy, their payment app brings the same level of quality found in their tech products.

Featuring debit card and credit card transactions, as well as in-store payments and in-app purchases, Samsung Pay is a flexible online payments provider for people already invested in Samsung’s product ecosystem.

It’s also one of the more secure payment apps, with fingerprint and PIN authentication, anti-theft protection, and iris scan authentication all available for additional peace of mind.

4. Google Pay

Best For Google Product Users

If you aren’t interested in payment apps that can be used with a credit card, Google Pay allows you to easily link your bank account, debit card, and Google Pay balance to send money to people through Gmail and other Google products.

Any funds transferred through Google Pay are not subject to any fees, with verified accounts able to send up to $5,000 during a seven-day period, and you can even send money to groups to easily split expenses.

Pros

- Can be used on both Android and iOS devices

- Can take 3-5 days to receive funds sent from a bank account

- No fees applied to send money to friends and family

Cons

- Money transfers from a debit card come with a fee of 1.5%

- Unverified accounts face a transfer limit of $500 during a seven-day period

- Other payment apps are more widely accepted

Bottom Line

Google has come a long way since the business started in a garage, and with millions of people already fully invested in the Google digital ecosystem, Google Pay is an effective way to integrate online payment options into their services.

While it can take some time for funds to transfer from the app account, and you can’t use a credit card, it’s a well-designed app with reasonable payment limits, which is intuitive to use and fits well in Google’s suite of products.

It’s also among the best payment apps for those who enjoy renting and buying content on YouTube, and there is a range of loyalty program options available, including Coca-Cola, Walgreens, and Yogurtland’s Real Rewards program.

Google Pay also works closely with small businesses, with a recent collaboration with Indifi aiming to address issues of working with capital management to offer instant credit and help them start their business journey.

3. Apple Pay

Best For Apple Product Users

iPhone owners looking for a compatible payment app that accepts credit cards should consider adding Apple Pay to their devices, which also gives them access to Apple Cash so they can receive and send money through Messages.

With no fees charged for using Apple Pay, users can send and receive up to $3,000 per message and $10,000 for each transaction covering a seven-day period.

Apple Pay is also compatible with most major financial institutions, so you can quickly link it to your bank account or credit card to send money quickly and securely.

Pros

- Compatible with all Apple devices, including iPhone, iPad, Mac devices, and Apple Watch

- Platform is very secure, reducing the risk of unauthorized transactions

- Can be accessed without an internet connection, for example, when a device is in airplane mode

Cons

- Instant transfer withdrawals come with a 1% fee of up to $10

- If you send money from a credit card, you’ll pay a 3% fee

Bottom Line

If you’re an Apple product consumer looking for one of the best payment apps for this platform, Apple Pay offers a great combination of ease of use, solid security features which shield your credit card and bank account information, and impressive payment limits.

It works on all Apple devices, including the MacBook Pro 24 karat gold, one of the most expensive laptops you can buy (if you happen to have $30,000 to spare).

It’s also an excellent way to consolidate your cards, monthly membership fees, and other payments into a straightforward system, whether using it for in-person or online purchases.

Apple Pay can be installed via the Apple app store, and once information from credit cards has been added, you can make instant payments by simply placing your phone near an NFC scanner and using the iPhone’s Touch ID to accept the purchase with your fingerprint.

2. Wise

Best For Regular International Payments

While some payment apps only allow you to receive and transfer funds from within the US, the Wise app stands out for its versatile application for international payments based on standard exchange rates.

With a multi-currency account, users can avoid the typical SWIFT fees of around 3% to 4% of the total amount, offering a cheaper alternative for people who regularly send money abroad.

You can use Wise to send money to over 100 different countries, which expands to even more locations if the recipient’s account accepts U.S. dollars, euros, or British pounds.

Pros

- Personal accounts come with a daily limit of $1,000,000 and an annual limit of $5,000,000

- Can enable two-factor authentication for additional security

- Avoids large international transaction fees and unfavorable exchange rates

Cons

- Slower than some payment apps

- Lacks protection through a financial protection scheme

Bottom Line

With its exceptionally high transfer capability and excellent support for international currencies, the Wise payment app is ideal for international businesses.

Business accounts enjoy a much higher daily and annual limit than personal accounts, too, with a $3,000,000 daily limit and $15,000,000 annual limit, so if you’re hoping to become one of the richest people in the world, this app could be an excellent place to start.

1. PayPal

Best For All Round Payments

The most widely used of all the payment apps, PayPal is the go-to platform to send money via instant transfers from your accounts.

Setting up a PayPal account only takes a few minutes, and while you can send funds from credit cards, setting up a bank account and debit card means you can process payments for family and friends with ease.

Initial limits are also high, and you can send up to $60,000 from a verified account, making it another solid payment app for people who run their own business.

Pros

- Very easy to use

- Transfers to friends and family are free

- PayPal Cash Plus account includes direct deposit and mobile check cashing

Cons

- PayPal can freeze your account and funds without explanation

- Credit card payments come with a fixed fee of 2.9%

Bottom Line

The success of PayPal laid the foundation for Elon Musk’s net worth, and the company has gone on to become the industry leader in digital payment apps for both personal and professional applications.

The PayPal app brings low-fee transactions with the ability to check your PayPal balance online quickly, as well as purchase from most stores available online.

There’s also the option to sign up for PayPal credit cards, which adds more versatility to an already flexible payment service.

With such a vast user base, PayPal is the go-to service for personal and professional use, with a quick transfer speed that exceeds most other digital payment companies.

Summary

Choosing the best payment app means researching a broad range of features and limitations to make sure it covers all your needs.

We’ve broken down the pros and cons of the ten best apps you can download, helping you understand what fees to expect, how much you can send and receive in each transaction, and any other key features you need to be aware of.

Here’s a quick recap of the 10 best payment apps:

- PayPal

- Wise

- Apple Pay

- Google Pay

- Samsung Pay

- Venmo

- Stripe

- Meta Messenger

- Zelle

- Cash App

What’s the best payment app, in your opinion? Leave a comment below.

Top Lists

The 10 Best Short Moral Stories With Valuable Lessons

Stories that have morals and messages behind them are always powerful. In fact, it’s crazy just how powerful a 200 word story can be.

Our last article of short stories became so popular, that we decided to create another list, in which every story has a simple moral behind it.

The 10 Best Short Moral Stories

Some of these stories are very short and basic. In fact some are so basic they’re most likely featured in children’s books somewhere. However, the strength of the message remains the same.

Here’s some more of the best short moral stories:

1. An Old Man Lived in the Village

An old man lived in the village. He was one of the most unfortunate people in the world. The whole village was tired of him; he was always gloomy, he constantly complained and was always in a bad mood.

The longer he lived, the more bile he was becoming and the more poisonous were his words. People avoided him, because his misfortune became contagious. It was even unnatural and insulting to be happy next to him.

He created the feeling of unhappiness in others.

But one day, when he turned eighty years old, an incredible thing happened. Instantly everyone started hearing the rumour:

“An Old Man is happy today, he doesn’t complain about anything, smiles, and even his face is freshened up.”

The whole village gathered together. The old man was asked:

Villager: What happened to you?

“Nothing special. Eighty years I’ve been chasing happiness, and it was useless. And then I decided to live without happiness and just enjoy life. That’s why I’m happy now.” – An Old Man

Moral of the story:

Don’t chase happiness. Enjoy your life.

2. The Wise Man

People have been coming to the wise man, complaining about the same problems every time. One day he told them a joke and everyone roared in laughter.

After a couple of minutes, he told them the same joke and only a few of them smiled.

When he told the same joke for the third time no one laughed anymore.

The wise man smiled and said:

“You can’t laugh at the same joke over and over. So why are you always crying about the same problem?”

Moral of the story:

Worrying won’t solve your problems, it’ll just waste your time and energy.

3. The Foolish Donkey

A salt seller used to carry the salt bag on his donkey to the market every day.

On the way they had to cross a stream. One day the donkey suddenly tumbled down the stream and the salt bag also fell into the water. The salt dissolved in the water and hence the bag became very light to carry. The donkey was happy.

Then the donkey started to play the same trick every day.

The salt seller came to understand the trick and decided to teach a lesson to it. The next day he loaded a cotton bag on the donkey.

Again it played the same trick hoping that the cotton bag would be still become lighter.

But the dampened cotton became very heavy to carry and the donkey suffered. It learnt a lesson. It didn’t play the trick anymore after that day, and the seller was happy.

Moral of the story:

Luck won’t favor always.

4. Having A Best Friend

A story tells that two friends were walking through the desert. During some point of the journey they had an argument, and one friend slapped the other one in the face.

The one who got slapped was hurt, but without saying anything, wrote in the sand;

“Today my best friend slapped me in the face.”

They kept on walking until they found an oasis, where they decided to take a bath. The one who had been slapped got stuck in the mire and started drowning, but the friend saved him. After he recovered from the near drowning, he wrote on a stone;

“Today my best friend saved my life.”

The friend who had slapped and saved his best friend asked him;

“After I hurt you, you wrote in the sand and now, you write on a stone, why?”

The other friend replied;

“When someone hurts us we should write it down in sand where winds of forgiveness can erase it away. But, when someone does something good for us, we must engrave it in stone where no wind can ever erase it.”

Moral of the story:

Don’t value the things you have in your life. But value who you have in your life.

5. The Four Smart Students

One night four college students were out partying late night and didn’t study for the test which was scheduled for the next day. In the morning, they thought of a plan.

They made themselves look dirty with grease and dirt.

Then they went to the Dean and said they had gone out to a wedding last night and on their way back the tire of their car burst and they had to push the car all the way back. So they were in no condition to take the test.

The Dean thought for a minute and said they can have the re-test after 3 days. They thanked him and said they will be ready by that time.

On the third day, they appeared before the Dean. The Dean said that as this was a Special Condition Test, all four were required to sit in separate classrooms for the test. They all agreed as they had prepared well in the last 3 days.

The Test consisted of only 2 questions with the total of 100 Points:

1) Your Name? __________ (1 Points)

2) Which tire burst? __________ (99 Points)

Options – (a) Front Left (b) Front Right (c) Back Left (d) Back Right

Moral of the story:

Take responsibility or you will learn your lesson.

6. The Greedy Lion

It was an incredibly hot day, and a lion was feeling very hungry.

He came out of his den and searched here and there. He could find only a small hare. He caught the hare with some hesitation. “This hare can’t fill my stomach” thought the lion.

As the lion was about to kill the hare, a deer ran that way. The lion became greedy. He thought;

“Instead of eating this small hare, let me eat the big deer.”

He let the hare go and went behind the deer. But the deer had vanished into the forest. The lion now felt sorry for letting the hare off.

Moral of the story:

A bird in hand is worth two in the bush.

7. Two Friends & The Bear

Vijay and Raju were friends. On a holiday they went walking into a forest, enjoying the beauty of nature. Suddenly they saw a bear coming at them. They became frightened.

Raju, who knew all about climbing trees, ran up to a tree and climbed up quickly. He didn’t think of Vijay. Vijay had no idea how to climb the tree.

Vijay thought for a second. He’d heard animals don’t prefer dead bodies, so he fell to the ground and held his breath. The bear sniffed him and thought he was dead. So, it went on its way.

Raju asked Vijay;

“What did the bear whisper into your ears?”

Vijay replied, “The bear asked me to keep away from friends like you” …and went on his way.

Moral of the story:

A friend in need is a friend indeed.

8. The Struggles of Our Life

Once upon a time a daughter complained to her father that her life was miserable and that she didn’t know how she was going to make it.

She was tired of fighting and struggling all the time. It seemed just as one problem was solved, another one soon followed.

Her father, a chef, took her to the kitchen. He filled three pots with water and placed each on a high fire.

Once the three pots began to boil, he placed potatoes in one pot, eggs in the second pot and ground coffee beans in the third pot. He then let them sit and boil, without saying a word to his daughter.

The daughter, moaned and impatiently waited, wondering what he was doing. After twenty minutes he turned off the burners.

He took the potatoes out of the pot and placed them in a bowl. He pulled the eggs out and placed them in a bowl. He then ladled the coffee out and placed it in a cup.

Turning to her, he asked. “Daughter, what do you see?”

“Potatoes, eggs and coffee,” she hastily replied.

“Look closer” he said, “and touch the potatoes.” She did and noted that they were soft.

He then asked her to take an egg and break it. After pulling off the shell, she observed the hard-boiled egg.

Finally, he asked her to sip the coffee. Its rich aroma brought a smile to her face.

“Father, what does this mean?” she asked.

He then explained that the potatoes, the eggs and coffee beans had each faced the same adversity-the boiling water. However, each one reacted differently. The potato went in strong, hard and unrelenting, but in boiling water, it became soft and weak.

The egg was fragile, with the thin outer shell protecting its liquid interior until it was put in the boiling water. Then the inside of the egg became hard.

However, the ground coffee beans were unique. After they were exposed to the boiling water, they changed the water and created something new.

“Which one are you?” he asked his daughter.

“When adversity knocks on your door, how do you respond? Are you a potato, an egg, or a coffee bean?”

Moral of the story:

In life, things happen around us, things happen to us, but the only thing that truly matters is how you choose to react to it and what you make out of it. Life is all about leaning, adopting and converting all the struggles that we experience into something positive.

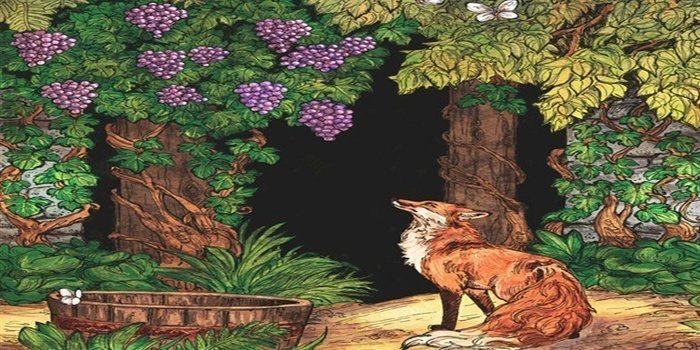

9. The Fox & The Grapes

One afternoon a fox was walking through the forest and spotted a bunch of grapes hanging from over a lofty branch.

“Just the thing to quench my thirst,” he thought.

Taking a few steps back, the fox jumped and just missed the hanging grapes. Again the fox took a few paces back and tried to reach them but still failed.

Finally, giving up, the fox turned up his nose and said, “They’re probably sour anyway,” and proceeded to walk away.

Moral of the story:

It’s easy to despise what you can’t have.

10. The Lion & The Poor Slave

A slave, ill-treated by his master, runs away to the forest. There he comes across a lion in pain because of a thorn in his paw. The slave bravely goes forward and removes the thorn gently.

The lion without hurting him goes away.

Some days later, the slave’s master comes hunting to the forest and catches many animals and cages them. The slave is spotted by the masters’ men who catch him and bring him to the cruel master.

The master asks for the slave to be thrown into the lion’s cage.

The slave is awaiting his death in the cage when he realizes that it is the same lion that he had helped. The slave rescued the lion and all other caged animals.

Moral of the story:

One should help others in need, we get the rewards of our helpful acts in return.

Summary

Here’s a quick recap on the 10 best short moral stories:

- An old man lived in the village

- The wise man

- The foolish donkey

- Having a best friend

- The four smart students

- The greedy lion

- The two friends & the bear

- The struggles of our life

- The fox & the grapes

- The lion & the poor slave

If you haven’t seen our original article, with slightly more detailed inspirational short stories, check it out!

Do you have any other favorite short moral stories? Leave a comment below.

Top Lists

The 10 Best Motivational Speakers in the World

Who are the best motivational speakers of all time?

Motivational speakers have had an enormous impact on my life, and millions of others, no matter what their personal situation in life may be.

Their words are so powerful and inspirational, you just have to listen to their stuff on a daily basis. So it brings me to this post.

I’ve been enjoying a lot of motivational videos recently, have been creating my own, and have ended up listening to a lot of wonderful speeches.

Top 10 Best Motivational Speakers

But who are the best motivational speakers in the world?

Here’s my list of the top 10 motivational speakers in the world.

These are the people you need to be following, listening to and watching on YouTube. They have transformed many people’s lives including mine.

10. Nick Vujicic

Nick Vujicic was born on December 4th 1982 in Melbourne, Australia. Vujicic was born with Tetra-Amelia syndrome, a very rare disorder whereby someone is born with an absence of all four limbs.

This no doubt ably, made things incredibly tough for Nick growing up, as he struggled both mentally and physically.

It led to him founding his very own non-profit organization called ‘Life Without Limbs’. Nick Vujicic is a true inspiration to us all, and if you’ve watched some of his motivational speeches on YouTube, you’ll realize just how much he’s been able to adapt to a life without limbs.

Many people with this disorder might not be willing to work hard in order to truly push their abilities.

He can type 43 words a minute on a computer. That’s right, you heard me correctly. This is a guy who has an absence of all four limbs, but can type 43 words per minute on a computer.

I encourage you to watch some of his videos on YouTube, and see exactly what I’m talking about.

“It’s a lie to think you’re not good enough. It’s a lie to think you’re not worth anything.” – nick Vujicic

9. Brian Tracy

Brian Tracy was born on January 5th 1944 in Vancouver, Canada, and is the CEO of Brian Tracy International, a company that specifically sets out to help individuals and organizations develop, train and grow.

Brian’s ultimate goal is to help other people achieve their goals more efficiently and be able to achieve their full potential.

That definitely sets the foundation for being one of the best motivational speakers in the world.

His lifetime achievements are phenomenal, consulting huge numbers of businesses, hosting huge numbers of seminars and conducting years and years of research in Business, Economics, Psychology and Philosophy.

There’s no more to say other than the title given on his website: Professional Speaker, Best Selling Author, Entrepreneur and Success Expert. Check out some of the best Brian Tracy quotes.

“No one lives long enough to learn everything they need to learn starting from scratch. To be successful, we absolutely, positively have to find people who have already paid the price to learn the things that we need to learn to achieve our goals.” – Brian Tracy

8. Robin Sharma

Robin Sharma was born in 1964 in Nepal, and straight out of the Dalhousie University School of Law, became a professional lawyer. But he went much further in his career than being a fully qualified and successful lawyer.

Sharma has written a total of 15 published books, from 1995 – 2011, on the subjects of self-help and leadership. One of his most popular books written; ‘The Monk Who Sold his Ferrari’, has sold over 5 million copies worldwide.

The book is all about a character called Julian, who decides to sell his home and Ferrari to go on a spiritual journey, after being the victim to a sudden heart attack.

Some may say that Robin Sharma’s more of a motivational author rather than speaker, but he deserves to be on this list. He’s written 12 global best sellers, and is an expert author in the world of leadership and self development.

“Dreamers are mocked as impractical. The truth is they are the most practical, as their innovations lead to progress and a better way of life for all of us.” – Robin S. Sharma

7. Wayne Dyer

Dr. Wayne Dyer was born on May 10th 1940 in Detroit, and spent the majority of his childhood in an orphanage.

Dyer was in the U.S Navy after graduating high school, from 1958 to 1962. He then received his degree in counselling, a profession that he chose to work in for a while before taking it one step further.

Dyer left his teaching job and started pursuing a career in motivational speaking, holding various lectures across the states and becoming an incredibly popular author.

The first book that Dyer ever wrote has now had over 35 million copies sold and he’s proceeded to continue with his lecture tours, release various audio tapes and publish a regular stream of books.

“Passion is a feeling that tells you: this is the right thing to do. Nothing can stand in my way. It doesn’t matter what anyone else says. This feeling is so good that it cannot be ignored. I’m going to follow my bliss and act upon this glorious sensation of joy.” – Wayne Dyer

6. Zig Ziglar

Zig Ziglar was born on November 6th, 1926 in Alabama, and passed away on November 28th in 2012.

Ziglar has 11 siblings, and at the age of five years old, his father died of a stroke, and his sister passed away two days later. Zig actually served in the army from 1935 – 1946 during World War II.

Ziglar met his wife Jean when he was just 17 years old, and after the war began to work as a salesman for many different companies, eventually becoming the vice president for the Automotive Performance company.

He started taking part in motivational seminars, and also wrote his first book in 1975 titled: ‘See You at the Top’. This was the first of at least 15 books he’d written during the period of 1975 and 2012.

A lot of wisdom has come from Zig Ziglar over the years and he is definitely one of the best motivational speakers in the world.

“You were designed for accomplishment, engineered for success, and endowed with the seeds of greatness.” – Zig Ziglar

5. Arnold Schwarzenegger

Arnold Schwarzenegger was born on July 30th 1947, in Austria. We all know him as the world famous professional bodybuilding champion, and there’s a very inspirational story behind Arnie’s bodybuilding success.

Schwarzenegger served in the Austrian army at the age of 18 years old for 1 year, which at the time was compulsory for all 18-year-old males.

During this time, he would still manage to fit in his workouts between all the training and drills, whilst most people were resting. He snuck out of the camp to compete in the Junior Mr. Europe contest, which he ended up winning.

Arnold’s discipline towards his training was incredible, and the fact that he was willing to disobey the rules of the army and sneak out of the camp to compete in the contest, just goes to show how badly he wanted it.

Nowadays, he’s an inspiration to many bodybuilders and a great source of motivation for anyone wanting to be successful.

“For me life is continuously being hungry. The meaning of life is not simply to exist, to survive, but to move ahead, to go up, to achieve, to conquer.” – Arnold Schwarzenegger

4. Jim Rohn

Jim Rohn was born September 17th, 1930 in Yakima, Washington, and passed away on December 5th, 2009. He was a very successful entrepreneur, at one time being a Vice President of a very successful sales company, Nutri-Bio.

However, after the company eventually went out of business, he was invited to speak at a meeting of one of his clubs.

After this meeting, he was invited to speak at many other events and began making a name for himself. Rohn was a wise businessman and managed to impart much of this wisdom to others.

He’s definitely earned the right to be on this list of the best motivational speakers in the world.

“If you don’t design your own life plan, chances are you’ll fall into someone else’s plan. And guess what they have planned for you? Not much.” – Jim Rohn

3. Les Brown

Les Brown was born on February 17th, 1945 in Miami, Florida. He was adopted by Mamie Brown, and whilst in grade school, was declared “educably mentally retarded”.

Despite this and the emotional issues, it brought upon him; he was encouraged by others to continue to learn and be the best he could be. Leading him to unlock his full potential.

Les is another motivational speaker who is incredibly popular among the motivational video compilations that others create. Because his speeches are so deep and meaningful that they really get through to people.

His top-selling books: ‘It’s Not over until You Win!’ and ‘Live Your Dreams’ are truly inspirational and well worth the read.

“When life knocks you down, try to land on your back. Because if you can look up, you can get up. Let your reason get you back up.” – Les Brown

2. Tony Robbins

Tony Robbins was born on February 29th, 1960 in Los Angeles. His life at home when he was young was described by him as abusive and chaotic. It was because of this that he left home at the age of 17.

Originally when starting out in the world of motivational speaking, Robbins was promoting seminars for Jim Rohn. He later decided to begin his own journey by hosting his own seminars.

Tony has affected and changed so many people’s lives in a positive way through his seminars, motivational speeches, inspirational quotes and best-selling books.

Search for him on YouTube and several videos will pop up showing him change someone’s life.

The favorites of mine that I’ve watched, are where he cures a young man’s stutter in 7 minutes and saves another guy’s marriage in 8.

“One reason so few of us achieve what we truly want is that we never direct our focus; we never concentrate our power. Most people dabble their way through life, never deciding to master anything in particular.” – Tony Robbins

1. Eric Thomas

Eric Thomas, born and raised in Detroit, was homeless at the age of 16 years old. But Eric decided that he wanted to make a better life for himself, to become someone with a life he could be proud of.

E.T did just that, and you can now check out powerful advice from Eric Thomas on YouTube. Including his “Thank God It’s Monday” series.

He also managed to get the education he missed out on whilst he was homeless and pushed himself further to achieve all the qualifications he dreamed of being able to achieve.

Eric Thomas has become one of the best motivational speakers in the world. His YouTube videos are legendary and his best-selling books have taken in millions of dollars in revenue.

E.T’s speeches are so popular, that you’ll find he’s featured in roughly 90% of the motivational videos that others create and upload to YouTube, using compilations of clips, speeches, and music.

“When you want to succeed as bad as you want to breathe, then you’ll be successful.” – Eric Thomas

Summary

I hope you enjoyed this list of the top 10 best motivational speakers in the world. Many of these speakers are featured within some of the videos we included in our new list of ultimate gym motivation. Take a look and see what you think.

Here’s a quick recap on the list of the best motivational speakers in the world::

- Eric Thomas

- Tony Robbins

- Les Brown

- Jim Rohn

- Arnold Schwarzenegger

- Zig Ziglar

- Dr. Wayne Dyer

- Robin Sharma

- Brian Tracy

- Nick Vujicic

Who’s your favorite of the 10 best motivational speakers? Do you still agree with the current order of this list? Leave a comment below.

Top Lists

The 10 Most Inspirational Short Stories I’ve Heard

Short Inspirational stories are powerful reads;

The great thing about them is that they’re so easy to digest, and there’s always a moral at the end of the story.

Whether they’re true stories or not is another thing, as many of them are legends supposedly hundreds of years old.

However, the stories that I’m talking about are so powerful and inspirational that many of them really do get you thinking and even leave you speechless at times.

The 10 Best Inspirational Short Stories

I’ve been reading plenty of these short stories in the past couple of weeks and found the lessons behind them truly wonderful. So I’ve decided to write out this article highlighting the 10 most inspirational short stories I’ve heard.

Next to the subheadings, in brackets, I’ve put what the story’s lesson is all about, with a short description of the moral of the story at the end of each section.

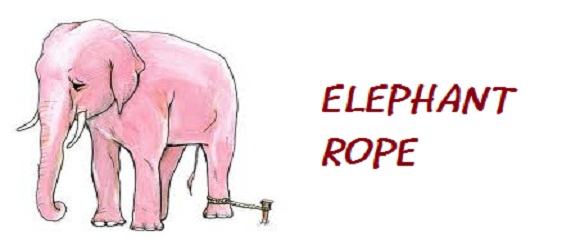

10. The Elephant Rope (Belief)

A gentleman was walking through an elephant camp, and he spotted that the elephants weren’t being kept in cages or held by the use of chains.

All that was holding them back from escaping the camp, was a small piece of rope tied to one of their legs.

As the man gazed upon the elephants, he was completely confused as to why the elephants didn’t just use their strength to break the rope and escape the camp. They could easily have done so, but instead, they didn’t try to at all.

Curious and wanting to know the answer, he asked a trainer nearby why the elephants were just standing there and never tried to escape.

The trainer replied;

“when they are very young and much smaller we use the same size rope to tie them and, at that age, it’s enough to hold them. As they grow up, they are conditioned to believe they cannot break away. They believe the rope can still hold them, so they never try to break free.”

The only reason that the elephants weren’t breaking free and escaping from the camp was that over time they adopted the belief that it just wasn’t possible.

Moral of the story:

No matter how much the world tries to hold you back, always continue with the belief that what you want to achieve is possible. Believing you can become successful is the most important step in actually achieving it.

9. Thinking Out of the Box (Creative Thinking)

In a small Italian town, hundreds of years ago, a small business owner owed a large sum of money to a loan-shark. The loan-shark was a very old, unattractive looking guy that just so happened to fancy the business owner’s daughter.

He decided to offer the businessman a deal that would completely wipe out the debt he owed him. However, the catch was that we would only wipe out the debt if he could marry the businessman’s daughter.

Needless to say, this proposal was met with a look of disgust.

The loan-shark said that he would place two pebbles into a bag, one white and one black.

The daughter would then have to reach into the bag and pick out a pebble. If it was black, the debt would be wiped, but the loan-shark would then marry her. If it was white, the debt would also be wiped, but the daughter wouldn’t have to marry the loan-shark.

Standing on a pebble-strewn path in the businessman’s garden, the loan-shark bent over and picked up two pebbles.

Whilst he was picking them up, the daughter noticed that he’d picked up two black pebbles and placed them both into the bag.

He then asked the daughter to reach into the bag and pick one.

The daughter naturally had three choices as to what she could have done:

- Refuse to pick a pebble from the bag.

- Take both pebbles out of the bag and expose the loan-shark for cheating.

- Pick a pebble from the bag fully well knowing it was black and sacrifice herself for her father’s freedom.

She drew out a pebble from the bag, and before looking at it ‘accidentally’ dropped it into the midst of the other pebbles. She said to the loan-shark;

“Oh, how clumsy of me. Never mind, if you look into the bag for the one that is left, you will be able to tell which pebble I picked.”

The pebble left in the bag is obviously black, and seeing as the loan-shark didn’t want to be exposed, he had to play along as if the pebble the daughter dropped was white, and clear her father’s debt.

Moral of the story:

It’s always possible to overcome a tough situation throughout of the box thinking, and not give in to the only options you think you have to pick from.

8. The Group of Frogs (Encouragement)

As a group of frogs was traveling through the woods, two of them fell into a deep pit. When the other frogs crowded around the pit and saw how deep it was, they told the two frogs that there was no hope left for them.

However, the two frogs decided to ignore what the others were saying and they proceeded to try and jump out of the pit.

Despite their efforts, the group of frogs at the top of the pit were still saying that they should just give up. That they would never make it out.

Eventually, one of the frogs took heed to what the others were saying and he gave up, falling down to his death. The other frog continued to jump as hard as he could. Again, the crowd of frogs yelled at him to stop the pain and just die.

He jumped even harder and finally made it out. When he got out, the other frogs said, “Did you not hear us?”

The frog explained to them that he was deaf. He thought they were encouraging him the entire time.

Moral of the story:

People’s words can have a big effect on other’s lives. Think about what you say before it comes out of your mouth. It might just be the difference between life and death.

7. A Pound of Butter (Honesty)

There was a farmer who sold a pound of butter to a baker. One day the baker decided to weigh the butter to see if he was getting the right amount, which he wasn’t. Angry about this, he took the farmer to court.

The judge asked the farmer if he was using any measure to weight the butter. The farmer replied, “Honor, I am primitive. I don’t have a proper measure, but I do have a scale.”

The judge asked, “Then how do you weigh the butter?”

The farmer replied;

“Your Honor, long before the baker started buying butter from me, I have been buying a pound loaf of bread from him. Every day when the baker brings the bread, I put it on the scale and give him the same weight in butter. If anyone is to be blamed, it is the baker.”

Moral of the story:

In life, you get what you give. Don’t try and cheat others.

6. The Obstacle In Our Path (Opportunity)

In ancient times, a King had a boulder placed on a roadway. He then hid himself and watched to see if anyone would move the boulder out of the way. Some of the king’s wealthiest merchants and courtiers came by and simply walked around it.

Many people loudly blamed the King for not keeping the roads clear, but none of them did anything about getting the stone out of the way.

A peasant then came along carrying a load of vegetables. Upon approaching the boulder, the peasant laid down his burden and tried to push the stone out of the road. After much pushing and straining, he finally succeeded.

After the peasant went back to pick up his vegetables, he noticed a purse lying in the road where the boulder had been.

The purse contained many gold coins and a note from the King explaining that the gold was for the person who removed the boulder from the roadway.

Moral of the story:

Every obstacle we come across in life gives us an opportunity to improve our circumstances, and whilst the lazy complain, the others are creating opportunities through their kind hearts, generosity, and willingness to get things done.

5. The Butterfly (Struggles)

A man found a cocoon of a butterfly.

One day a small opening appeared. He sat and watched the butterfly for several hours as it struggled to force its body through that little hole.

Until it suddenly stopped making any progress and looked like it was stuck.

So the man decided to help the butterfly. He took a pair of scissors and snipped off the remaining bit of the cocoon. The butterfly then emerged easily, although it had a swollen body and small, shriveled wings.

The man didn’t think anything of it and sat there waiting for the wings to enlarge to support the butterfly. But that didn’t happen. The butterfly spent the rest of its life unable to fly, crawling around with tiny wings and a swollen body.

Despite the kind heart of the man, he didn’t understand that the restricting cocoon and the struggle needed by the butterfly to get itself through the small opening; were God’s way of forcing fluid from the body of the butterfly into its wings. To prepare itself for flying once it was out of the cocoon.

Moral of the story:

Our struggles in life develop our strengths. Without struggles, we never grow and never get stronger, so it’s important for us to tackle challenges on our own, and not be relying on help from others.

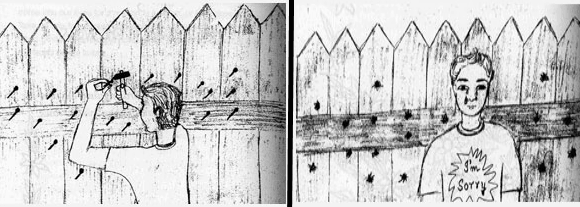

4. Control Your Temper (Anger)

There once was a little boy who had a very bad temper. His father decided to hand him a bag of nails and said that every time the boy lost his temper, he had to hammer a nail into the fence.

On the first day, the boy hammered 37 nails into that fence.

The boy gradually began to control his temper over the next few weeks, and the number of nails he was hammering into the fence slowly decreased.

He discovered it was easier to control his temper than to hammer those nails into the fence.

Finally, the day came when the boy didn’t lose his temper at all. He told his father the news and the father suggested that the boy should now pull out a nail every day he kept his temper under control.

The days passed and the young boy was finally able to tell his father that all the nails were gone. The father took his son by the hand and led him to the fence.

“you have done well, my son, but look at the holes in the fence. The fence will never be the same. When you say things in anger, they leave a scar just like this one. You can put a knife in a man and draw it out. It won’t matter how many times you say I’m sorry, the wound is still there.”

Moral of the story:

Control your anger, and don’t say things to people in the heat of the moment, that you may later regret. Some things in life, you are unable to take back.

3. The Blind Girl (Change)

There was a blind girl who hated herself purely for the fact she was blind. The only person she didn’t hate was her loving boyfriend, as he was always there for her. She said that if she could only see the world, she would marry him.

One day, someone donated a pair of eyes to her – now she could see everything, including her boyfriend. Her boyfriend asked her, “now that you can see the world, will you marry me?”

The girl was shocked when she saw that her boyfriend was blind too, and refused to marry him. Her boyfriend walked away in tears, and later wrote a letter to her saying:

“Just take care of my eyes dear.”

Moral of the story:

When our circumstances change, so does our mind. Some people may not be able to see the way things were before, and might not be able to appreciate them. There are many things to take away from this story, not just one.

This is one of the inspirational short stories that left me speechless.

2. Puppies for Sale (Understanding)

A shop owner placed a sign above his door that said: “Puppies For Sale.”

Signs like this always have a way of attracting young children, and to no surprise, a boy saw the sign and approached the owner;

“How much are you going to sell the puppies for?” he asked.

The store owner replied, “Anywhere from $30 to $50.”

The little boy pulled out some change from his pocket. “I have $2.37,” he said. “Can I please look at them?”

The shop owner smiled and whistled. Out of the kennel came Lady, who ran down the aisle of his shop followed by five teeny, tiny balls of fur.

One puppy was lagging considerably behind. Immediately the little boy singled out the lagging, limping puppy and said, “What’s wrong with that little dog?”

The shop owner explained that the veterinarian had examined the little puppy and had discovered it didn’t have a hip socket. It would always limp. It would always be lame.

The little boy became excited. “That is the puppy that I want to buy.”

The shop owner said, “No, you don’t want to buy that little dog. If you really want him, I’ll just give him to you.”

The little boy got quite upset. He looked straight into the store owner’s eyes, pointing his finger, and said;

“I don’t want you to give him to me. That little dog is worth every bit as much as all the other dogs and I’ll pay full price. In fact, I’ll give you $2.37 now, and 50 cents a month until I have him paid for.”

The shop owner countered, “You really don’t want to buy this little dog. He is never going to be able to run and jump and play with you like the other puppies.”

To his surprise, the little boy reached down and rolled up his pant leg to reveal a badly twisted, crippled left leg supported by a big metal brace. He looked up at the shop owner and softly replied, “Well, I don’t run so well myself, and the little puppy will need someone who understands!”

1. Box Full of Kisses (Love)

Some time ago, a man punished his 3-year-old daughter for wasting a roll of gold wrapping paper. Money was tight and he became infuriated when the child tried to decorate a box to put under the Christmas tree.

Nevertheless, the little girl brought the gift to her father the next morning and said, “This is for you, Daddy.”

The man became embarrassed by his overreaction earlier, but his rage continue when he saw that the box was empty. He yelled at her; “Don’t you know, when you give someone a present, there is supposed to be something inside?”

The little girl looked up at him with tears in her eyes and cried;

“Oh, Daddy, it’s not empty at all. I blew kisses into the box. They’re all for you, Daddy.”

The father was crushed. He put his arms around his little girl, and he begged for her forgiveness.

Only a short time later, an accident took the life of the child.

Her father kept the gold box by his bed for many years and, whenever he was discouraged, he would take out an imaginary kiss and remember the love of the child who had put it there.

Moral of the story:

Love is the most precious gift in the world.

Summary of the 10 Best Inspirational Stories

Here’s a quick summary of the 10 best short inspirational stories:

- Box Full of Kisses (Love)

- Puppies for Sale (Understanding)

- The Blind Girl (Change)

- Control Your Temper (Anger)

- The Butterfly (Struggles)

- The Obstacle in Our Path (Opportunity)

- A Pound of Butter (Honesty)

- The Group of Frogs (Encouragement)

- Thinking Out of the Box (Creative Thinking)

- The Elephant Rope (Belief)

Thanks for reading these inspirational short stories. Some of them left me speechless for a minute or two, and it really does make us think.

If you know of any other inspirational short stories that you think should be featured on the list, then let me know in the comments below or drop me an email and I’ll feature them in part two later on in the year.

Which are your favorite inspirational short stories? Leave a comment below.

-

Richest People2 years ago

Richest People2 years agoThe 30 Richest People in the World

-

Richest People1 year ago

Richest People1 year agoThe 50 Richest Rappers in the World

-

Richest People1 year ago

Richest People1 year agoThe World’s 50 Richest Singers

-

Richest People2 years ago

Richest People2 years agoThe 50 Richest Actors in the World

-

Richest People2 years ago

Richest People2 years agoThe 50 Richest Athletes On Earth

-

Entrepreneurs1 year ago

Entrepreneurs1 year agoJeff Bezos Net Worth

-

Richest People2 years ago

Richest People2 years agoThe 50 Richest DJs in the World

-

Top Lists2 years ago

Top Lists2 years agoThe 10 Most Inspirational Short Stories I’ve Heard