Top Lists

The 10 Worst Shark Tank Deals Ever

What are the worst shark tank deals ever?

Starting a new business can be a daunting venture, with a long history of new companies crashing and burning before their owners have a chance to succeed.

Entrepreneurs looking for a cash injection can turn to the TV show Shark Tank, presenting their business ideas to potential investors along with a vast audience on national television in the hopes of getting a deal.

While some find success with their new company, others aren’t so lucky, so let’s explore some of the worst Shark Tank deals ever made and find out exactly what went wrong.

The 10 Worst Shark Tank Deals Ever

Our ranked lists are created by researching and rounding up information from the most reputable web sources.

Here’s our list of the 10 worst shark tank deals ever:

10. You Smell Soap

Investment: $55,000 + $50,000 Salary For 30% Equity

Megan Cummins appeared on Shark Tank season 3, episode 3, and pitched her luxury soap brand You Smell Soap to the sharks.

While some successful businesses started in garages, You Smell Soap began life as a college project based around custom packaging, transforming into a fully-fledged startup when she had two scents made into 1200 bars of soap to use for market testing.

Initially, things were looking good for Megan’s business, after she made a deal with Robert Herjavec for an initial outlay of $55,000 for the luxury soap company and a $50,000 salary for 30% equity.

Unfortunately, things didn’t work out quite as planned, and after unsuccessful attempts to chase Robert Herjavec up, six months later, he returned with an adjusted offer of $50,000 for 50% of the company.

Megan refused the offer, which was a frustrating experience for the young entrepreneur, who managed to continue running the company with the help of another investor.

Megan missed a big opportunity with another shark in the tank, Mark Cuban, who had initially expressed interest in investing with You Smell Soap, but she decided to go with Robert Herjavec instead.

9. Three65 Underwear

Investment: $60,000 For 25% Equity

Applying the subscription model to clothing and accessories can be incredibly lucrative, with companies such as Dollar Shave Club bringing in millions of dollars in revenue.

William Strange spotted an opportunity to apply this model to high-quality men’s underwear and visited the sharks to pitch his idea for the Three65 Underwear business.

After some negotiation with the shark tank angel investors, Strange managed to secure a deal with Naomi Simson and Janine Allis, each offering $60,000 for 25% equity of his company.

While they were concerned that Strange might not have the time and attention to give to the company, since he was already running a GPS business called Sports Performance Tracking, they had faith in the subscription model he proposed.

Since Strange was working two sharks at the same time, he was warned that eventually, he would have to make a decision.

In a surprise twist, William Strange ended up pulling out of the deal and going all-in with his own business, StartupSmart, since this company was growing in revenue and attracting much larger investment opportunities.

8. CATEapp

Investment: $70,000 For 35% Equity

Dating apps feature among the most successful apps released in 2021, with consumers spending $133 billion overall on apps for their mobile devices.

CATEapp, the brainchild of West Palm Beach police officer Phil Immler, can be viewed more as a cheating app than a dating app, allowing users to hide “secret” text messages and conversations from their spouses.

CATE is short for “call and text eraser,” and the smartphone app was picked up by entrepreneur Neal Desai, who took it to the shark tank investors hoping for a deal.

After some negotiation and discussion about the ethics of facilitating infidelity, a final deal of $70,000 for 35% equity was struck between Desai, Kevin O’Leary, and Daymond John.

In spite of nearly 10,000 downloads in the aftermath of the show (70% of which was from women), the business deal fell through, even as Desai had begun marketing the app to government agencies and other businesses as a “privacy app.”

CATEapp is long since defunct, the last update on its Twitter business account from 2013, but the market for smartphone apps for cheaters hasn’t gone away, with apps like CheatMaster available for the unfaithful.

7. ShowNo Towels

Investment: $75,000 For 25% Equity

Shelly Ehler’s concept for her ShowNo towels proves that simplicity is often key, with these poncho-like bathing towels ideal for getting changed in public while keeping your decorum.

Ehler took the business idea to Shark Tank in episode 4 of season 3, looking for a $50,000 investment for a 25% stake in the company, bringing her two sons along to help pitch the idea.

After a few questions about production processes and some competition for the deal with other investors, Ehler accepted an offer from Lori Greiner for $75,000 for a 25% stake.

After the show, ShowNo Towels looked like it would thrive, with a deal struck to supply towels to Disneyland and Shelly and Lori appearing on the Today Show to drum up more support.

Unfortunately, after working together for a year and despite the initial popularity of the product, the business ended, with the website no longer selling the towels.

6. Qubits

Investment: $90,000 For 51% Equity

In the first season of Shark Tank, Mark Burginger took his Qubits invention to the show, a puzzle-based toy that can be manipulated into different geometric shapes.

Burginger saw an opportunity to break into a potentially lucrative market, with the most valuable toys selling for tens of thousands of dollars.

Seeking an investment of $90,000, Mark Burginger was prepared to offer a stake of 51%, a deal which Daymond John eventually took.

A condition of the deal meant that Burginger had to look into pairing with one of the four top toy companies, which he agreed to.

Daymond John enlisted the help of Kevin O’Leary to help promote Qubits to larger investors, but despite their best efforts, by March of 2010, their deal ended with Mark Burginger.

Despite this initial lack of interest from the toy companies, following the break with Shark Tank, Burginger was able to strike a deal with Discovery Toys, LLC, with their wholesale order allowing Qubits Toy Company to erase all its debt.

Impressive sales saw the Qubits toys quickly selling out, with units shifted in the USA and Canada reaching up to six figures in retail sales.

5. The Body Jac

Investment: $180,000 For 50% Equity

The inventor of the Body Jac sought to revolutionize exercise equipment, and entrepreneur and infomercial star Jack Barringer took it to Shark Tank hoping for a $180,000 investment in the business.

The Body Jac device was designed to make push-ups easier, so potential investors Kevin Harrington and Barbara Corcoran instructed him to lose 30 pounds to prove his exercise equipment was up to the task.

After losing the required weight, Barringer received the $180,000 funds for 50% equity from Corcoran and Kevin Harrington.

According to Showbiz Cheat Sheet, it’s not clear why the business was a failure, but the company discontinued its production of the Body Jac push-ups machine, shutting down their website in 2012.

Corcoran described Barringer as a “fast-talking cowboy,” with his invention best remembered as “the worst business deal ever made” in the show’s history.

4. Night Runner

Investment: $250,000 For 15% Equity

The creation of Doug and Renata Storer, the Night Runner posed a solution to the problem of running in the dark by fixing rechargeable LED lights to running shoes.

The two partners took their idea to Shark Tank, looking for $250,000 in exchange for a 15% equity stake in the company, and secured an offer from Robert Herjavec.

However, once the show ended, the Storers decided it was in their best interest to take their company in a different direction, retaining their equity and taking on more risk themselves.

In an interview with Forbes, Doug Storer explained, “After it aired, we didn’t need the investment anymore, and we started to think, why should we give up equity if we don’t need it.”

After reneging on their deal with Herjavec, the Night Runner company found investors from elsewhere and were able to transform their product into a consistent seller, making $1.5 million in revenue in the first year.

It’s a reminder that not every Shark Tank deal which goes south works out badly for the entrepreneur; they can sometimes present missed opportunities for the five sharks on the panel.

3. Sweet Ballz

Investment: $250,000 For 25% Equity

James McDonald and Cole Egger set up their cake ball company, Sweet Ballz, and took the food innovation concept to Shark Tank in the hopes of acquiring $250,000 in exchange for 25% of the company.

Their business model involved producing Sweet Ballz for sale at a variety of retail outlets including 7-11, with Mark Cuban the most likely candidate to invest in their new business.

After Mark agreed to the deal, and Barbara Corocan also came on board, the relationship between James McDonald and Cole Egger began to sour as their Sweet Ballz cake ball company ran into trouble.

With one believing the other was operating behind his back, a competing Cake Ballz brand set up by Egger further inflamed tensions and eventually led to a restraining order being issued.

A lawsuit between James McDonald and Cole Egger soon followed, and things became more fraught when the Sweet Ballz website began redirecting traffic to CakeBallz.com.

Once the dust had settled, and the feud ended, ownership of the Sweet Ballz cake ball company went back to McDonald, its original creator.

While James McDonald and Cole Egger couldn’t repair their relationship, Mark Cuban and Barbara Corcoran made the right decision.

The company went on to thrive, striking deals with some of America’s top food service providers, its founders proving to be successful businessmen.

2. ToyGaroo

Investment: $250,000 For 35% Equity

With children well known for quickly getting bored with their toys, the idea that parents could rent toys from a subscription service sounds great — or at least, it does on paper.

The company ToyGaroo set out to do just that, allowing parents to rent toys on a monthly basis, saving them money while giving their kids more variety with their playthings.

Mark Cuban and Kevin O’Leary both agreed that this was a great idea, and over the course of two funding rounds, they put up the $250,000 required to get the business off the ground in exchange for 35% equity in the business.

Unfortunately, ToyGaroo failed, unable to meet the high demand caused by the spike in interest when the show was aired, leading to the company being a victim of its success.

Lacking the stock to meet this demand was a death blow to the company, and founder Phil Smy believed they would have been a success had they been able to grow organically.

Slower growth would have given them the time needed to refine the “free shipping” model they wanted to use but were hampered by the different dimensions each toy came in.

Additionally, they struggled to source their toys at affordable prices, and hopes that Mark Cuban and Kevin O’Leary would help them secure a deal with Mattel came to nothing.

On April 6, 2012, the company filed Chapter 7, officially closing its doors for good in 2016.

When interviewed by Forbes, Kevin O’Leary and Mark Cuban described the ToyGaroo company as a “great concept, but they were unable to execute.”

1. Breathometer

Investment: $1 Million For 30% Equity

Another idea that sounded great on paper is the Breathometer, a portable breathalyzer device connected via a smartphone app, allowing users to check their blood alcohol level before driving.

Created by entrepreneur Charles Michael Yim, the Breathometer required $1 million in exchange for 30% equity in the company, and all five sharks enthusiastically took up the deal.

If the device worked as intended, this might have been a great deal.

However, problems with it giving the wrong blood alcohol levels led to the involvement of the Federal Trade Commission, which ordered the company to issue full refunds to all of its customers.

In addition to the faulty product, the company failed to fulfill its orders and was seriously mismanaging funds.

Mark Cuban described the venture as “the worst execution in the history of Shark Tank,” ultimately blaming Yim for misspending the capital which had been put into his company.

Nevertheless, Breathometer is still in business and has pivoted toward measuring biomarkers that indicate bad breath and gum disease, where it hopes to acquire new customers.

Summary

We’ve covered some of Shark Tank’s biggest failures, from morally questionable apps designed to help people cheat on their partners to a portable breathalyzer that failed to work as intended.

These failed investment opportunities have left both the shark tank hosts and aspiring entrepreneurs out of pocket, despite exposure to over five million viewers throughout the country.

Still, with only 12 companies of the 210 companies featured on the show between seasons five to nine actually failing, budding startup owners would do well to try and book a slot on Shark Tank if they want to increase their odds of success.

Here’s a quick recap of the 10 worst shark tank deals ever:

- Breathometer

- ToyGaroo

- Sweet Ballz

- Night Runner

- The Body Jac

- Qubits

- ShowNo Towels

- CATEapp

- Three65 Underwear

- You Smell Soap

What’s your favorite worst shark tank deal ever? Leave a comment below.

Top Lists

The 10 Best Short Moral Stories With Valuable Lessons

Stories that have morals and messages behind them are always powerful. In fact, it’s crazy just how powerful a 200 word story can be.

Our last article of short stories became so popular, that we decided to create another list, in which every story has a simple moral behind it.

The 10 Best Short Moral Stories

Some of these stories are very short and basic. In fact some are so basic they’re most likely featured in children’s books somewhere. However, the strength of the message remains the same.

Here’s some more of the best short moral stories:

1. An Old Man Lived in the Village

An old man lived in the village. He was one of the most unfortunate people in the world. The whole village was tired of him; he was always gloomy, he constantly complained and was always in a bad mood.

The longer he lived, the more bile he was becoming and the more poisonous were his words. People avoided him, because his misfortune became contagious. It was even unnatural and insulting to be happy next to him.

He created the feeling of unhappiness in others.

But one day, when he turned eighty years old, an incredible thing happened. Instantly everyone started hearing the rumour:

“An Old Man is happy today, he doesn’t complain about anything, smiles, and even his face is freshened up.”

The whole village gathered together. The old man was asked:

Villager: What happened to you?

“Nothing special. Eighty years I’ve been chasing happiness, and it was useless. And then I decided to live without happiness and just enjoy life. That’s why I’m happy now.” – An Old Man

Moral of the story:

Don’t chase happiness. Enjoy your life.

2. The Wise Man

People have been coming to the wise man, complaining about the same problems every time. One day he told them a joke and everyone roared in laughter.

After a couple of minutes, he told them the same joke and only a few of them smiled.

When he told the same joke for the third time no one laughed anymore.

The wise man smiled and said:

“You can’t laugh at the same joke over and over. So why are you always crying about the same problem?”

Moral of the story:

Worrying won’t solve your problems, it’ll just waste your time and energy.

3. The Foolish Donkey

A salt seller used to carry the salt bag on his donkey to the market every day.

On the way they had to cross a stream. One day the donkey suddenly tumbled down the stream and the salt bag also fell into the water. The salt dissolved in the water and hence the bag became very light to carry. The donkey was happy.

Then the donkey started to play the same trick every day.

The salt seller came to understand the trick and decided to teach a lesson to it. The next day he loaded a cotton bag on the donkey.

Again it played the same trick hoping that the cotton bag would be still become lighter.

But the dampened cotton became very heavy to carry and the donkey suffered. It learnt a lesson. It didn’t play the trick anymore after that day, and the seller was happy.

Moral of the story:

Luck won’t favor always.

4. Having A Best Friend

A story tells that two friends were walking through the desert. During some point of the journey they had an argument, and one friend slapped the other one in the face.

The one who got slapped was hurt, but without saying anything, wrote in the sand;

“Today my best friend slapped me in the face.”

They kept on walking until they found an oasis, where they decided to take a bath. The one who had been slapped got stuck in the mire and started drowning, but the friend saved him. After he recovered from the near drowning, he wrote on a stone;

“Today my best friend saved my life.”

The friend who had slapped and saved his best friend asked him;

“After I hurt you, you wrote in the sand and now, you write on a stone, why?”

The other friend replied;

“When someone hurts us we should write it down in sand where winds of forgiveness can erase it away. But, when someone does something good for us, we must engrave it in stone where no wind can ever erase it.”

Moral of the story:

Don’t value the things you have in your life. But value who you have in your life.

5. The Four Smart Students

One night four college students were out partying late night and didn’t study for the test which was scheduled for the next day. In the morning, they thought of a plan.

They made themselves look dirty with grease and dirt.

Then they went to the Dean and said they had gone out to a wedding last night and on their way back the tire of their car burst and they had to push the car all the way back. So they were in no condition to take the test.

The Dean thought for a minute and said they can have the re-test after 3 days. They thanked him and said they will be ready by that time.

On the third day, they appeared before the Dean. The Dean said that as this was a Special Condition Test, all four were required to sit in separate classrooms for the test. They all agreed as they had prepared well in the last 3 days.

The Test consisted of only 2 questions with the total of 100 Points:

1) Your Name? __________ (1 Points)

2) Which tire burst? __________ (99 Points)

Options – (a) Front Left (b) Front Right (c) Back Left (d) Back Right

Moral of the story:

Take responsibility or you will learn your lesson.

6. The Greedy Lion

It was an incredibly hot day, and a lion was feeling very hungry.

He came out of his den and searched here and there. He could find only a small hare. He caught the hare with some hesitation. “This hare can’t fill my stomach” thought the lion.

As the lion was about to kill the hare, a deer ran that way. The lion became greedy. He thought;

“Instead of eating this small hare, let me eat the big deer.”

He let the hare go and went behind the deer. But the deer had vanished into the forest. The lion now felt sorry for letting the hare off.

Moral of the story:

A bird in hand is worth two in the bush.

7. Two Friends & The Bear

Vijay and Raju were friends. On a holiday they went walking into a forest, enjoying the beauty of nature. Suddenly they saw a bear coming at them. They became frightened.

Raju, who knew all about climbing trees, ran up to a tree and climbed up quickly. He didn’t think of Vijay. Vijay had no idea how to climb the tree.

Vijay thought for a second. He’d heard animals don’t prefer dead bodies, so he fell to the ground and held his breath. The bear sniffed him and thought he was dead. So, it went on its way.

Raju asked Vijay;

“What did the bear whisper into your ears?”

Vijay replied, “The bear asked me to keep away from friends like you” …and went on his way.

Moral of the story:

A friend in need is a friend indeed.

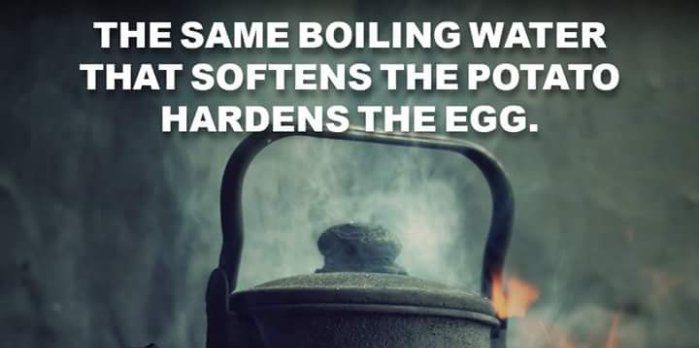

8. The Struggles of Our Life

Once upon a time a daughter complained to her father that her life was miserable and that she didn’t know how she was going to make it.

She was tired of fighting and struggling all the time. It seemed just as one problem was solved, another one soon followed.

Her father, a chef, took her to the kitchen. He filled three pots with water and placed each on a high fire.

Once the three pots began to boil, he placed potatoes in one pot, eggs in the second pot and ground coffee beans in the third pot. He then let them sit and boil, without saying a word to his daughter.

The daughter, moaned and impatiently waited, wondering what he was doing. After twenty minutes he turned off the burners.

He took the potatoes out of the pot and placed them in a bowl. He pulled the eggs out and placed them in a bowl. He then ladled the coffee out and placed it in a cup.

Turning to her, he asked. “Daughter, what do you see?”

“Potatoes, eggs and coffee,” she hastily replied.

“Look closer” he said, “and touch the potatoes.” She did and noted that they were soft.

He then asked her to take an egg and break it. After pulling off the shell, she observed the hard-boiled egg.

Finally, he asked her to sip the coffee. Its rich aroma brought a smile to her face.

“Father, what does this mean?” she asked.

He then explained that the potatoes, the eggs and coffee beans had each faced the same adversity-the boiling water. However, each one reacted differently. The potato went in strong, hard and unrelenting, but in boiling water, it became soft and weak.

The egg was fragile, with the thin outer shell protecting its liquid interior until it was put in the boiling water. Then the inside of the egg became hard.

However, the ground coffee beans were unique. After they were exposed to the boiling water, they changed the water and created something new.

“Which one are you?” he asked his daughter.

“When adversity knocks on your door, how do you respond? Are you a potato, an egg, or a coffee bean?”

Moral of the story:

In life, things happen around us, things happen to us, but the only thing that truly matters is how you choose to react to it and what you make out of it. Life is all about leaning, adopting and converting all the struggles that we experience into something positive.

9. The Fox & The Grapes

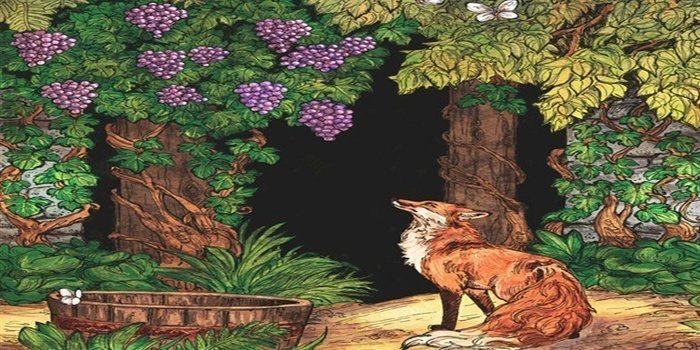

One afternoon a fox was walking through the forest and spotted a bunch of grapes hanging from over a lofty branch.

“Just the thing to quench my thirst,” he thought.

Taking a few steps back, the fox jumped and just missed the hanging grapes. Again the fox took a few paces back and tried to reach them but still failed.

Finally, giving up, the fox turned up his nose and said, “They’re probably sour anyway,” and proceeded to walk away.

Moral of the story:

It’s easy to despise what you can’t have.

10. The Lion & The Poor Slave

A slave, ill-treated by his master, runs away to the forest. There he comes across a lion in pain because of a thorn in his paw. The slave bravely goes forward and removes the thorn gently.

The lion without hurting him goes away.

Some days later, the slave’s master comes hunting to the forest and catches many animals and cages them. The slave is spotted by the masters’ men who catch him and bring him to the cruel master.

The master asks for the slave to be thrown into the lion’s cage.

The slave is awaiting his death in the cage when he realizes that it is the same lion that he had helped. The slave rescued the lion and all other caged animals.

Moral of the story:

One should help others in need, we get the rewards of our helpful acts in return.

Summary

Here’s a quick recap on the 10 best short moral stories:

- An old man lived in the village

- The wise man

- The foolish donkey

- Having a best friend

- The four smart students

- The greedy lion

- The two friends & the bear

- The struggles of our life

- The fox & the grapes

- The lion & the poor slave

If you haven’t seen our original article, with slightly more detailed inspirational short stories, check it out!

Do you have any other favorite short moral stories? Leave a comment below.

Top Lists

The 10 Best Motivational Speakers in the World

Who are the best motivational speakers of all time?

Motivational speakers have had an enormous impact on my life, and millions of others, no matter what their personal situation in life may be.

Their words are so powerful and inspirational, you just have to listen to their stuff on a daily basis. So it brings me to this post.

I’ve been enjoying a lot of motivational videos recently, have been creating my own, and have ended up listening to a lot of wonderful speeches.

Top 10 Best Motivational Speakers

But who are the best motivational speakers in the world?

Here’s my list of the top 10 motivational speakers in the world.

These are the people you need to be following, listening to and watching on YouTube. They have transformed many people’s lives including mine.

10. Nick Vujicic

Nick Vujicic was born on December 4th 1982 in Melbourne, Australia. Vujicic was born with Tetra-Amelia syndrome, a very rare disorder whereby someone is born with an absence of all four limbs.

This no doubt ably, made things incredibly tough for Nick growing up, as he struggled both mentally and physically.

It led to him founding his very own non-profit organization called ‘Life Without Limbs’. Nick Vujicic is a true inspiration to us all, and if you’ve watched some of his motivational speeches on YouTube, you’ll realize just how much he’s been able to adapt to a life without limbs.

Many people with this disorder might not be willing to work hard in order to truly push their abilities.

He can type 43 words a minute on a computer. That’s right, you heard me correctly. This is a guy who has an absence of all four limbs, but can type 43 words per minute on a computer.

I encourage you to watch some of his videos on YouTube, and see exactly what I’m talking about.

“It’s a lie to think you’re not good enough. It’s a lie to think you’re not worth anything.” – nick Vujicic

9. Brian Tracy

Brian Tracy was born on January 5th 1944 in Vancouver, Canada, and is the CEO of Brian Tracy International, a company that specifically sets out to help individuals and organizations develop, train and grow.

Brian’s ultimate goal is to help other people achieve their goals more efficiently and be able to achieve their full potential.

That definitely sets the foundation for being one of the best motivational speakers in the world.

His lifetime achievements are phenomenal, consulting huge numbers of businesses, hosting huge numbers of seminars and conducting years and years of research in Business, Economics, Psychology and Philosophy.

There’s no more to say other than the title given on his website: Professional Speaker, Best Selling Author, Entrepreneur and Success Expert. Check out some of the best Brian Tracy quotes.

“No one lives long enough to learn everything they need to learn starting from scratch. To be successful, we absolutely, positively have to find people who have already paid the price to learn the things that we need to learn to achieve our goals.” – Brian Tracy

8. Robin Sharma

Robin Sharma was born in 1964 in Nepal, and straight out of the Dalhousie University School of Law, became a professional lawyer. But he went much further in his career than being a fully qualified and successful lawyer.

Sharma has written a total of 15 published books, from 1995 – 2011, on the subjects of self-help and leadership. One of his most popular books written; ‘The Monk Who Sold his Ferrari’, has sold over 5 million copies worldwide.

The book is all about a character called Julian, who decides to sell his home and Ferrari to go on a spiritual journey, after being the victim to a sudden heart attack.

Some may say that Robin Sharma’s more of a motivational author rather than speaker, but he deserves to be on this list. He’s written 12 global best sellers, and is an expert author in the world of leadership and self development.

“Dreamers are mocked as impractical. The truth is they are the most practical, as their innovations lead to progress and a better way of life for all of us.” – Robin S. Sharma

7. Wayne Dyer

Dr. Wayne Dyer was born on May 10th 1940 in Detroit, and spent the majority of his childhood in an orphanage.

Dyer was in the U.S Navy after graduating high school, from 1958 to 1962. He then received his degree in counselling, a profession that he chose to work in for a while before taking it one step further.

Dyer left his teaching job and started pursuing a career in motivational speaking, holding various lectures across the states and becoming an incredibly popular author.

The first book that Dyer ever wrote has now had over 35 million copies sold and he’s proceeded to continue with his lecture tours, release various audio tapes and publish a regular stream of books.

“Passion is a feeling that tells you: this is the right thing to do. Nothing can stand in my way. It doesn’t matter what anyone else says. This feeling is so good that it cannot be ignored. I’m going to follow my bliss and act upon this glorious sensation of joy.” – Wayne Dyer

6. Zig Ziglar

Zig Ziglar was born on November 6th, 1926 in Alabama, and passed away on November 28th in 2012.

Ziglar has 11 siblings, and at the age of five years old, his father died of a stroke, and his sister passed away two days later. Zig actually served in the army from 1935 – 1946 during World War II.

Ziglar met his wife Jean when he was just 17 years old, and after the war began to work as a salesman for many different companies, eventually becoming the vice president for the Automotive Performance company.

He started taking part in motivational seminars, and also wrote his first book in 1975 titled: ‘See You at the Top’. This was the first of at least 15 books he’d written during the period of 1975 and 2012.

A lot of wisdom has come from Zig Ziglar over the years and he is definitely one of the best motivational speakers in the world.

“You were designed for accomplishment, engineered for success, and endowed with the seeds of greatness.” – Zig Ziglar

5. Arnold Schwarzenegger

Arnold Schwarzenegger was born on July 30th 1947, in Austria. We all know him as the world famous professional bodybuilding champion, and there’s a very inspirational story behind Arnie’s bodybuilding success.

Schwarzenegger served in the Austrian army at the age of 18 years old for 1 year, which at the time was compulsory for all 18-year-old males.

During this time, he would still manage to fit in his workouts between all the training and drills, whilst most people were resting. He snuck out of the camp to compete in the Junior Mr. Europe contest, which he ended up winning.

Arnold’s discipline towards his training was incredible, and the fact that he was willing to disobey the rules of the army and sneak out of the camp to compete in the contest, just goes to show how badly he wanted it.

Nowadays, he’s an inspiration to many bodybuilders and a great source of motivation for anyone wanting to be successful.

“For me life is continuously being hungry. The meaning of life is not simply to exist, to survive, but to move ahead, to go up, to achieve, to conquer.” – Arnold Schwarzenegger

4. Jim Rohn

Jim Rohn was born September 17th, 1930 in Yakima, Washington, and passed away on December 5th, 2009. He was a very successful entrepreneur, at one time being a Vice President of a very successful sales company, Nutri-Bio.

However, after the company eventually went out of business, he was invited to speak at a meeting of one of his clubs.

After this meeting, he was invited to speak at many other events and began making a name for himself. Rohn was a wise businessman and managed to impart much of this wisdom to others.

He’s definitely earned the right to be on this list of the best motivational speakers in the world.

“If you don’t design your own life plan, chances are you’ll fall into someone else’s plan. And guess what they have planned for you? Not much.” – Jim Rohn

3. Les Brown

Les Brown was born on February 17th, 1945 in Miami, Florida. He was adopted by Mamie Brown, and whilst in grade school, was declared “educably mentally retarded”.

Despite this and the emotional issues, it brought upon him; he was encouraged by others to continue to learn and be the best he could be. Leading him to unlock his full potential.

Les is another motivational speaker who is incredibly popular among the motivational video compilations that others create. Because his speeches are so deep and meaningful that they really get through to people.

His top-selling books: ‘It’s Not over until You Win!’ and ‘Live Your Dreams’ are truly inspirational and well worth the read.

“When life knocks you down, try to land on your back. Because if you can look up, you can get up. Let your reason get you back up.” – Les Brown

2. Tony Robbins

Tony Robbins was born on February 29th, 1960 in Los Angeles. His life at home when he was young was described by him as abusive and chaotic. It was because of this that he left home at the age of 17.

Originally when starting out in the world of motivational speaking, Robbins was promoting seminars for Jim Rohn. He later decided to begin his own journey by hosting his own seminars.

Tony has affected and changed so many people’s lives in a positive way through his seminars, motivational speeches, inspirational quotes and best-selling books.

Search for him on YouTube and several videos will pop up showing him change someone’s life.

The favorites of mine that I’ve watched, are where he cures a young man’s stutter in 7 minutes and saves another guy’s marriage in 8.

“One reason so few of us achieve what we truly want is that we never direct our focus; we never concentrate our power. Most people dabble their way through life, never deciding to master anything in particular.” – Tony Robbins

1. Eric Thomas

Eric Thomas, born and raised in Detroit, was homeless at the age of 16 years old. But Eric decided that he wanted to make a better life for himself, to become someone with a life he could be proud of.

E.T did just that, and you can now check out powerful advice from Eric Thomas on YouTube. Including his “Thank God It’s Monday” series.

He also managed to get the education he missed out on whilst he was homeless and pushed himself further to achieve all the qualifications he dreamed of being able to achieve.

Eric Thomas has become one of the best motivational speakers in the world. His YouTube videos are legendary and his best-selling books have taken in millions of dollars in revenue.

E.T’s speeches are so popular, that you’ll find he’s featured in roughly 90% of the motivational videos that others create and upload to YouTube, using compilations of clips, speeches, and music.

“When you want to succeed as bad as you want to breathe, then you’ll be successful.” – Eric Thomas

Summary

I hope you enjoyed this list of the top 10 best motivational speakers in the world. Many of these speakers are featured within some of the videos we included in our new list of ultimate gym motivation. Take a look and see what you think.

Here’s a quick recap on the list of the best motivational speakers in the world::

- Eric Thomas

- Tony Robbins

- Les Brown

- Jim Rohn

- Arnold Schwarzenegger

- Zig Ziglar

- Dr. Wayne Dyer

- Robin Sharma

- Brian Tracy

- Nick Vujicic

Who’s your favorite of the 10 best motivational speakers? Do you still agree with the current order of this list? Leave a comment below.

Top Lists

The 10 Most Inspirational Short Stories I’ve Heard

Short Inspirational stories are powerful reads;

The great thing about them is that they’re so easy to digest, and there’s always a moral at the end of the story.

Whether they’re true stories or not is another thing, as many of them are legends supposedly hundreds of years old.

However, the stories that I’m talking about are so powerful and inspirational that many of them really do get you thinking and even leave you speechless at times.

The 10 Best Inspirational Short Stories

I’ve been reading plenty of these short stories in the past couple of weeks and found the lessons behind them truly wonderful. So I’ve decided to write out this article highlighting the 10 most inspirational short stories I’ve heard.

Next to the subheadings, in brackets, I’ve put what the story’s lesson is all about, with a short description of the moral of the story at the end of each section.

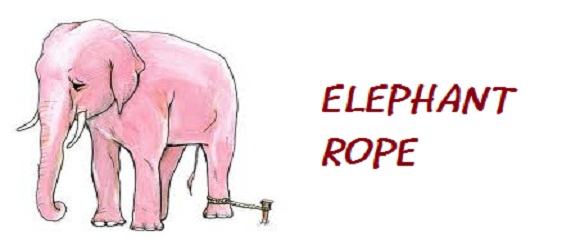

10. The Elephant Rope (Belief)

A gentleman was walking through an elephant camp, and he spotted that the elephants weren’t being kept in cages or held by the use of chains.

All that was holding them back from escaping the camp, was a small piece of rope tied to one of their legs.

As the man gazed upon the elephants, he was completely confused as to why the elephants didn’t just use their strength to break the rope and escape the camp. They could easily have done so, but instead, they didn’t try to at all.

Curious and wanting to know the answer, he asked a trainer nearby why the elephants were just standing there and never tried to escape.

The trainer replied;

“when they are very young and much smaller we use the same size rope to tie them and, at that age, it’s enough to hold them. As they grow up, they are conditioned to believe they cannot break away. They believe the rope can still hold them, so they never try to break free.”

The only reason that the elephants weren’t breaking free and escaping from the camp was that over time they adopted the belief that it just wasn’t possible.

Moral of the story:

No matter how much the world tries to hold you back, always continue with the belief that what you want to achieve is possible. Believing you can become successful is the most important step in actually achieving it.

9. Thinking Out of the Box (Creative Thinking)

In a small Italian town, hundreds of years ago, a small business owner owed a large sum of money to a loan-shark. The loan-shark was a very old, unattractive looking guy that just so happened to fancy the business owner’s daughter.

He decided to offer the businessman a deal that would completely wipe out the debt he owed him. However, the catch was that we would only wipe out the debt if he could marry the businessman’s daughter.

Needless to say, this proposal was met with a look of disgust.

The loan-shark said that he would place two pebbles into a bag, one white and one black.

The daughter would then have to reach into the bag and pick out a pebble. If it was black, the debt would be wiped, but the loan-shark would then marry her. If it was white, the debt would also be wiped, but the daughter wouldn’t have to marry the loan-shark.

Standing on a pebble-strewn path in the businessman’s garden, the loan-shark bent over and picked up two pebbles.

Whilst he was picking them up, the daughter noticed that he’d picked up two black pebbles and placed them both into the bag.

He then asked the daughter to reach into the bag and pick one.

The daughter naturally had three choices as to what she could have done:

- Refuse to pick a pebble from the bag.

- Take both pebbles out of the bag and expose the loan-shark for cheating.

- Pick a pebble from the bag fully well knowing it was black and sacrifice herself for her father’s freedom.

She drew out a pebble from the bag, and before looking at it ‘accidentally’ dropped it into the midst of the other pebbles. She said to the loan-shark;

“Oh, how clumsy of me. Never mind, if you look into the bag for the one that is left, you will be able to tell which pebble I picked.”

The pebble left in the bag is obviously black, and seeing as the loan-shark didn’t want to be exposed, he had to play along as if the pebble the daughter dropped was white, and clear her father’s debt.

Moral of the story:

It’s always possible to overcome a tough situation throughout of the box thinking, and not give in to the only options you think you have to pick from.

8. The Group of Frogs (Encouragement)

As a group of frogs was traveling through the woods, two of them fell into a deep pit. When the other frogs crowded around the pit and saw how deep it was, they told the two frogs that there was no hope left for them.

However, the two frogs decided to ignore what the others were saying and they proceeded to try and jump out of the pit.

Despite their efforts, the group of frogs at the top of the pit were still saying that they should just give up. That they would never make it out.

Eventually, one of the frogs took heed to what the others were saying and he gave up, falling down to his death. The other frog continued to jump as hard as he could. Again, the crowd of frogs yelled at him to stop the pain and just die.

He jumped even harder and finally made it out. When he got out, the other frogs said, “Did you not hear us?”

The frog explained to them that he was deaf. He thought they were encouraging him the entire time.

Moral of the story:

People’s words can have a big effect on other’s lives. Think about what you say before it comes out of your mouth. It might just be the difference between life and death.

7. A Pound of Butter (Honesty)

There was a farmer who sold a pound of butter to a baker. One day the baker decided to weigh the butter to see if he was getting the right amount, which he wasn’t. Angry about this, he took the farmer to court.

The judge asked the farmer if he was using any measure to weight the butter. The farmer replied, “Honor, I am primitive. I don’t have a proper measure, but I do have a scale.”

The judge asked, “Then how do you weigh the butter?”

The farmer replied;

“Your Honor, long before the baker started buying butter from me, I have been buying a pound loaf of bread from him. Every day when the baker brings the bread, I put it on the scale and give him the same weight in butter. If anyone is to be blamed, it is the baker.”

Moral of the story:

In life, you get what you give. Don’t try and cheat others.

6. The Obstacle In Our Path (Opportunity)

In ancient times, a King had a boulder placed on a roadway. He then hid himself and watched to see if anyone would move the boulder out of the way. Some of the king’s wealthiest merchants and courtiers came by and simply walked around it.

Many people loudly blamed the King for not keeping the roads clear, but none of them did anything about getting the stone out of the way.

A peasant then came along carrying a load of vegetables. Upon approaching the boulder, the peasant laid down his burden and tried to push the stone out of the road. After much pushing and straining, he finally succeeded.

After the peasant went back to pick up his vegetables, he noticed a purse lying in the road where the boulder had been.

The purse contained many gold coins and a note from the King explaining that the gold was for the person who removed the boulder from the roadway.

Moral of the story:

Every obstacle we come across in life gives us an opportunity to improve our circumstances, and whilst the lazy complain, the others are creating opportunities through their kind hearts, generosity, and willingness to get things done.

5. The Butterfly (Struggles)

A man found a cocoon of a butterfly.

One day a small opening appeared. He sat and watched the butterfly for several hours as it struggled to force its body through that little hole.

Until it suddenly stopped making any progress and looked like it was stuck.

So the man decided to help the butterfly. He took a pair of scissors and snipped off the remaining bit of the cocoon. The butterfly then emerged easily, although it had a swollen body and small, shriveled wings.

The man didn’t think anything of it and sat there waiting for the wings to enlarge to support the butterfly. But that didn’t happen. The butterfly spent the rest of its life unable to fly, crawling around with tiny wings and a swollen body.

Despite the kind heart of the man, he didn’t understand that the restricting cocoon and the struggle needed by the butterfly to get itself through the small opening; were God’s way of forcing fluid from the body of the butterfly into its wings. To prepare itself for flying once it was out of the cocoon.

Moral of the story:

Our struggles in life develop our strengths. Without struggles, we never grow and never get stronger, so it’s important for us to tackle challenges on our own, and not be relying on help from others.

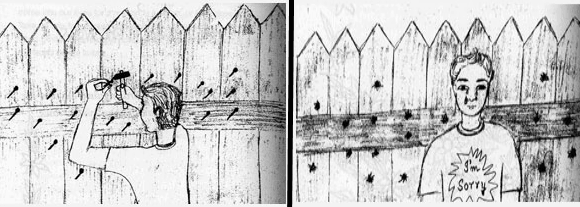

4. Control Your Temper (Anger)

There once was a little boy who had a very bad temper. His father decided to hand him a bag of nails and said that every time the boy lost his temper, he had to hammer a nail into the fence.

On the first day, the boy hammered 37 nails into that fence.

The boy gradually began to control his temper over the next few weeks, and the number of nails he was hammering into the fence slowly decreased.

He discovered it was easier to control his temper than to hammer those nails into the fence.

Finally, the day came when the boy didn’t lose his temper at all. He told his father the news and the father suggested that the boy should now pull out a nail every day he kept his temper under control.

The days passed and the young boy was finally able to tell his father that all the nails were gone. The father took his son by the hand and led him to the fence.

“you have done well, my son, but look at the holes in the fence. The fence will never be the same. When you say things in anger, they leave a scar just like this one. You can put a knife in a man and draw it out. It won’t matter how many times you say I’m sorry, the wound is still there.”

Moral of the story:

Control your anger, and don’t say things to people in the heat of the moment, that you may later regret. Some things in life, you are unable to take back.

3. The Blind Girl (Change)

There was a blind girl who hated herself purely for the fact she was blind. The only person she didn’t hate was her loving boyfriend, as he was always there for her. She said that if she could only see the world, she would marry him.

One day, someone donated a pair of eyes to her – now she could see everything, including her boyfriend. Her boyfriend asked her, “now that you can see the world, will you marry me?”

The girl was shocked when she saw that her boyfriend was blind too, and refused to marry him. Her boyfriend walked away in tears, and later wrote a letter to her saying:

“Just take care of my eyes dear.”

Moral of the story:

When our circumstances change, so does our mind. Some people may not be able to see the way things were before, and might not be able to appreciate them. There are many things to take away from this story, not just one.

This is one of the inspirational short stories that left me speechless.

2. Puppies for Sale (Understanding)

A shop owner placed a sign above his door that said: “Puppies For Sale.”

Signs like this always have a way of attracting young children, and to no surprise, a boy saw the sign and approached the owner;

“How much are you going to sell the puppies for?” he asked.

The store owner replied, “Anywhere from $30 to $50.”

The little boy pulled out some change from his pocket. “I have $2.37,” he said. “Can I please look at them?”

The shop owner smiled and whistled. Out of the kennel came Lady, who ran down the aisle of his shop followed by five teeny, tiny balls of fur.

One puppy was lagging considerably behind. Immediately the little boy singled out the lagging, limping puppy and said, “What’s wrong with that little dog?”

The shop owner explained that the veterinarian had examined the little puppy and had discovered it didn’t have a hip socket. It would always limp. It would always be lame.

The little boy became excited. “That is the puppy that I want to buy.”

The shop owner said, “No, you don’t want to buy that little dog. If you really want him, I’ll just give him to you.”

The little boy got quite upset. He looked straight into the store owner’s eyes, pointing his finger, and said;

“I don’t want you to give him to me. That little dog is worth every bit as much as all the other dogs and I’ll pay full price. In fact, I’ll give you $2.37 now, and 50 cents a month until I have him paid for.”

The shop owner countered, “You really don’t want to buy this little dog. He is never going to be able to run and jump and play with you like the other puppies.”

To his surprise, the little boy reached down and rolled up his pant leg to reveal a badly twisted, crippled left leg supported by a big metal brace. He looked up at the shop owner and softly replied, “Well, I don’t run so well myself, and the little puppy will need someone who understands!”

1. Box Full of Kisses (Love)

Some time ago, a man punished his 3-year-old daughter for wasting a roll of gold wrapping paper. Money was tight and he became infuriated when the child tried to decorate a box to put under the Christmas tree.

Nevertheless, the little girl brought the gift to her father the next morning and said, “This is for you, Daddy.”

The man became embarrassed by his overreaction earlier, but his rage continue when he saw that the box was empty. He yelled at her; “Don’t you know, when you give someone a present, there is supposed to be something inside?”

The little girl looked up at him with tears in her eyes and cried;

“Oh, Daddy, it’s not empty at all. I blew kisses into the box. They’re all for you, Daddy.”

The father was crushed. He put his arms around his little girl, and he begged for her forgiveness.

Only a short time later, an accident took the life of the child.

Her father kept the gold box by his bed for many years and, whenever he was discouraged, he would take out an imaginary kiss and remember the love of the child who had put it there.

Moral of the story:

Love is the most precious gift in the world.

Summary of the 10 Best Inspirational Stories

Here’s a quick summary of the 10 best short inspirational stories:

- Box Full of Kisses (Love)

- Puppies for Sale (Understanding)

- The Blind Girl (Change)

- Control Your Temper (Anger)

- The Butterfly (Struggles)

- The Obstacle in Our Path (Opportunity)

- A Pound of Butter (Honesty)

- The Group of Frogs (Encouragement)

- Thinking Out of the Box (Creative Thinking)

- The Elephant Rope (Belief)

Thanks for reading these inspirational short stories. Some of them left me speechless for a minute or two, and it really does make us think.

If you know of any other inspirational short stories that you think should be featured on the list, then let me know in the comments below or drop me an email and I’ll feature them in part two later on in the year.

Which are your favorite inspirational short stories? Leave a comment below.

-

Richest People2 years ago

Richest People2 years agoThe 30 Richest People in the World

-

Richest People1 year ago

Richest People1 year agoThe 50 Richest Rappers in the World

-

Richest People1 year ago

Richest People1 year agoThe World’s 50 Richest Singers

-

Richest People2 years ago

Richest People2 years agoThe 50 Richest Actors in the World

-

Richest People2 years ago

Richest People2 years agoThe 50 Richest Athletes On Earth

-

Entrepreneurs1 year ago

Entrepreneurs1 year agoJeff Bezos Net Worth

-

Richest People2 years ago

Richest People2 years agoThe 50 Richest DJs in the World

-

Top Lists2 years ago

Top Lists2 years agoThe 10 Most Inspirational Short Stories I’ve Heard